Products You May Like

Welcome to the wonderful world of tax refunds, where the dollars you receive after filing taxes can either bring a smile to your face or leave you scratching your head.

Taxes play a significant role in your financial life, and your annual tax refund can have a big impact. But how does it all work? This page aims to demystify the tax refund process and help you navigate the complexities of tax refunds with ease.

In this comprehensive guide, you’ll discover the importance of understanding your tax refund, explore the factors that can influence the refund amount you receive, and learn how to make the most of your tax refund money once it’s in your pocket. Whether you’re expecting a sizable windfall or a smaller refund, we’ve got you covered.

So, let’s dive in and unveil the secrets of your tax refund journey. Here is everything you need to know about tax refunds.

Basics of tax refunds

Tax refunds are the monetary returns you receive from the government, often stemming from overpaid taxes during the year. However, it’s not as simple as a direct reimbursement. Many factors play a role in determining your final refund amount. Here are seven key factors to consider when assessing your potential tax refund:

- Income level: Your AGI, or adjusted gross income, is a crucial figure in your tax return. It’s calculated by subtracting specific deductions from your gross income, and it helps determine your taxable income. The more you earn, the more you might owe in taxes, but it also means a potentially larger refund if you’ve overpaid.

- Filing status: Your filing status can significantly impact your tax liability and tax refund. When you file with us, our tax software will suggest the best filing status for you among five options, helping ensure you receive the most advantageous tax treatment.

- Deductions and credits: Tax deductions and credits can reduce the taxes you owe or increase your refund. It’s essential to answer all our interview questions accurately to identify the tax breaks available to you.

- Withholding: Adjusting your withholding through your Form W-4 can have a direct impact on your refund amount.

- Income sources: Different sources of income, such as investments, can affect your tax liability as well.

- Standard deduction vs. itemized deductions: You have the option to take the standard deduction or itemize your deductions, depending on which benefits you more. The standard deduction is a fixed amount that reduces your taxable income, while itemized deductions include various expenses that can potentially yield a larger deduction for some people.

- Life changes: Major life changes like getting married, having a child, or selling your house can impact your taxes in a big way. When e-filing your taxes using TaxAct®, we’ll ask you basic information about your life, including marital status, children, and significant events from the tax year. This information helps us identify potential tax credits and deductions based on your situation.

- Tax law changes: Keep an eye on changes in tax laws, as they can also influence your tax refund amount.

By considering these factors when e-filing your federal income tax return, you can ensure that you’re accurately representing your financial situation and taking advantage of all the available tax benefits. This approach not only simplifies the tax filing process but could also result in a larger refund. Make sure to answer all TaxAct’s questions accurately and choose the most beneficial filing status, deductions, and credits for your unique circumstances to optimize your federal tax return and receive the tax refund you are owed.

Why did my tax refund shrink?

Many American taxpayers saw smaller tax refunds in 2023 (for tax year 2022), so if you are wondering why you got a smaller tax refund, you’re not alone. Several factors, including recent tax law changes, contributed to this phenomenon.

Before delving into the specifics, let’s review why you receive a tax refund. Typically, a tax refund is a reimbursement of taxes you overpaid during the tax year, which can result from withholding more taxes than you owe or overestimating self-employment taxes. Additionally, refundable tax credits, such as the Child Tax Credit, can boost your refund when they exceed your tax liability.

The primary reasons for smaller tax refunds in 2023 were:

- Expiring pandemic relief measures: The expiration of pandemic-related tax credits, like the Child Tax Credit, reduced the value of these credits for tax year 2022. For instance, the Child Tax Credit has decreased from being fully refundable with a maximum of $3,000-$3,600 per child in 2021 to a maximum of $2,000 per child in 2022 onward.

- The economic environment: Factors like inflation, layoffs, and the stock market can also affect your tax refund. Inflation adjustments by the IRS may not cover all tax breaks, which could impact deductions like the capital loss deduction. Layoffs can lead to higher tax brackets (meaning higher tax rates) due to taxable severance payments, selling investments at a profit may incur capital gains taxes, etc.

To maximize your tax refund even when events like this occur in the future, consider the following tips:

- Know your tax credits: Familiarize yourself with the tax credits you qualify for. Some new tax breaks may become available during the year, and certain states offer additional tax rebates or relief depending on where you live. E-filing with tax software like TaxAct can help you identify and claim these credits.

- File early: Filing your tax return early can expedite the refund process, and it gives you more time to plan for and pay any taxes owed.

- Contribute to retirement and HSAs: Contributions to Individual Retirement Accounts (IRAs) and Health Savings Accounts (HSAs) can reduce your taxable income. Make sure to contribute before the tax deadline.

- Use investment losses: If you experienced losses from investments, you can use them to offset gains or deduct up to $3,000 in losses from your taxable income.

- Utilize TaxAct’s Refund Booster1: Make use of tools like our Refund Booster to plan for future tax years and potentially receive a larger tax refund.

If you know that your refund may not be as substantial as in previous years, proper planning is essential to manage your finances effectively.

In the next section, we’ll delve into estimating your tax refund and how to ensure you receive the maximum amount you’re entitled to.

Estimating your tax refund

When you plug your numbers into our income tax calculator, we can help you estimate your tax refund amount for the year. All you have to do is input your expected income, tax deductions, and tax credits. Using this information, the calculator will compute your estimated tax refund or amount owed. This estimate can help you make informed decisions about your tax planning.

Accurately estimating the taxes you will owe during the year is highly important for several reasons, as it helps individuals, families, and businesses plan for the future and adhere to tax laws. Here are some key reasons why accurate tax estimation is crucial and how this calculator can help you:

- Budgeting and financial planning: Estimating taxes allows individuals and businesses to create and maintain a realistic budget. Knowing how much you’ll owe in taxes helps you allocate funds for tax payments, preventing financial stress and ensuring that you have sufficient funds to cover your obligations when they come due. This, in turn, helps maintain overall financial stability.

- Avoiding penalties and interest: Underestimating taxes can lead to penalties and interest charges. If you don’t pay the required amount of taxes on time, the IRS or tax authorities may impose penalties and interest on the outstanding balance. Accurate tax estimation helps you avoid these costly consequences.

- Minimizing cash flow issues: Accurate tax estimation allows businesses to manage their cash flow effectively. When you know how much you’ll owe in taxes, you can plan for tax payments and ensure that your business has enough liquidity to cover those obligations without jeopardizing day-to-day operations.

- Preventing tax debt: Inaccurate tax estimation can result in accumulating tax debt, which can be financially burdensome. Tax debt can lead to collection efforts, including liens and levies, which can have serious consequences for individuals and businesses. Accurate estimation can help you prevent or reduce tax debt.

- Compliance with tax laws: Accurate tax estimation ensures that individuals and businesses are in compliance with tax laws. Failing to pay the correct amount of taxes can result in legal consequences, audits, and potentially criminal charges. Accurate estimation demonstrates a commitment to following the law.

- Strategic tax planning: Accurate estimation also plays a vital role in strategic tax planning. By knowing your tax liability, you can explore legal ways to minimize your tax burden, such as taking advantage of tax deductions, credits, and incentives. This can lead to significant savings and better financial outcomes.

- Financial reporting: If you happen to be a business owner, you probably know that businesses are often required to report their estimated taxes on financial statements, which can affect their financial ratios and investor perceptions. Accurate tax estimation enhances the transparency and reliability of financial reporting, which can be crucial if you’re trying to attract investors or secure a loan.

Benefits that increase your tax refund

It’s good to be aware of various tax savings opportunities that you can take advantage of to ease the process of filing your federal income taxes. These opportunities can encompass different aspects of your financial life, including family, education, homeownership, and employment. Let’s review some ways you could save this year (and possibly increase your tax refund while you’re at it).

Family-related tax benefits:

- The Child Tax Credit, can provide up to $2,000 per eligible child in 2023, particularly for taxpayers with earned incomes of up to $200,000 for single filers or $400,000 for joint filers.

- Parents who work or attend school and incur childcare expenses may qualify for the Child and Dependent Care Credit, offering a maximum credit of $1,050 for one child and $2,100 for two or more children.

- The Earned Income Credit can also be a valuable tax break if you are a working taxpayer with low to moderate income. If your family has three or more qualifying children, you can claim up to $7,430 using this credit in 2023.

Education-related tax breaks:

- If you’re dealing with student loans, there is an opportunity to deduct up to $2,500 in interest paid during 2023, contingent on your income.

- Students can also benefit from the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) for educational expenses.

- If you are contributing to a Coverdell Education Savings Account you can make annual contributions of up to $2,000, which will grow tax-free until withdrawn.

Tax benefits for homeowners:

- As a homeowner, you can utilize tax deductions, such as the mortgage interest deduction, which allows single filers or married couples filing jointly to deduct up to $750,000 in mortgage interest paid, or $375,000 for married individuals filing separately.

- Property tax deductions of up to $10,000 for joint filers or $5,000 for single or married filing separately individuals are also available.

- If you’re a home-based business owner you can also benefit from the home office deduction, which is based on the percentage of your home space used for business purposes.

These are just a few of the more common ways to boost your tax refund. Just make sure you gather all the necessary tax forms, receipts, and a copy of your prior year tax return before starting the tax preparation process.

Managing your tax refund

One of the most common questions taxpayers have is, “When will I get my tax refund?” We’ll walk you through the timeline for receiving your refund and provide tips on checking its status so you can anticipate its arrival.

Using the tool linked above, we can help you check your tax return’s e-file status. Knowing the status of your tax return will help you estimate when your tax refund may arrive. To use the tool, all you have to do is provide us with the following information:

- The year of the tax return you want to look up

- What type of tax return it is (individual, corporation, etc.)

- Your last name, zip code, and Social Security number

We can also help you track your federal tax refund and determine its status, as well as your state tax refund depending on what state income tax return(s) you filed.

How Form W-4 affects your tax refund

Did you know how you fill out Form W-4 with your employer can affect your tax refund amount? Here’s what you need to know about how Form W-4 affects your refund before you fill it out.

Form W-4 tells your employer how much federal income tax to withhold from your paycheck. The form was overhauled back in 2020 prompted by the Tax Cuts and Jobs Act, which eliminated personal exemptions and significantly increased the standard deduction. The changes aimed to simplify Form W-4 and align it with the revised tax code to ensure more accurate tax withholding. Form W-4 now consists of five sections, and you only need to fill out the ones relevant to your personal situation.

The first section gathers your personal information such as name, address, Social Security number (SSN), and filing status. The second section addresses multiple jobs, which you would fill out if you have more than one job or if you are a joint filer with a working spouse — this will help estimate any additional income correctly. The third section is for those with dependents to factor in the Child Tax Credit and adjust your withholding accordingly. The fourth section gives you the option to customize your withholding, and the final step involves signing and dating the form.

If you want to receive a larger tax refund when you file, you can modify line 4(c) on Form W-4. You can update your W-4 with your employer at any time, but you should especially make sure to review it after important life events such as marriage or the birth of a child, as these events can have a big impact on your tax situation, and subsequently, your withholding.

Tax refund booster

Speaking of adjusting your Form W-4 withholding — we can help with that too.

Introducing our Refund Booster1 tool, your key to fine-tuning your tax situation. Depending on whether you prefer a smaller tax refund and more money in your paychecks or a larger refund with less in each paycheck, this tool can help you fill out a new Form W-4 to match your needs.

To start, we’ll ask you if you got a tax refund this year or if you owed taxes, and how much you received or paid in. We’ll then ask if you want a bigger refund, bigger paycheck, the same as last year, or as close to zero as possible. Knowing your goals will help us help you fill out a Form W-4 that meets your needs.

We’ll also gather information on your filing status and how many jobs you (and your spouse, if applicable) have to ensure your withholding is as accurate as possible. We’ll ask you to provide us with any 401(k) contributions you plan to make during the year, as well as HSA, FSA, or pre-tax childcare credit account contributions. Since these contributions are pre-tax, it will help us get a better idea of your withholding needs.

You’ll also need to tell us about any dependents you have — this will help us factor in the Child Tax Credit — and any other income you plan on earning during the year (interest, dividends, retirement, etc.). We’ll also address some other miscellaneous questions about student loan interest you plan on paying and IRA contributions you plan on making. After that, all you need to do is give us some basic information like your name, SSN, and address so we can fully fill out your new Form W-4 for you. Once you sign it, you’ll be able to print the form and give it to your employer.

Receiving your tax refund

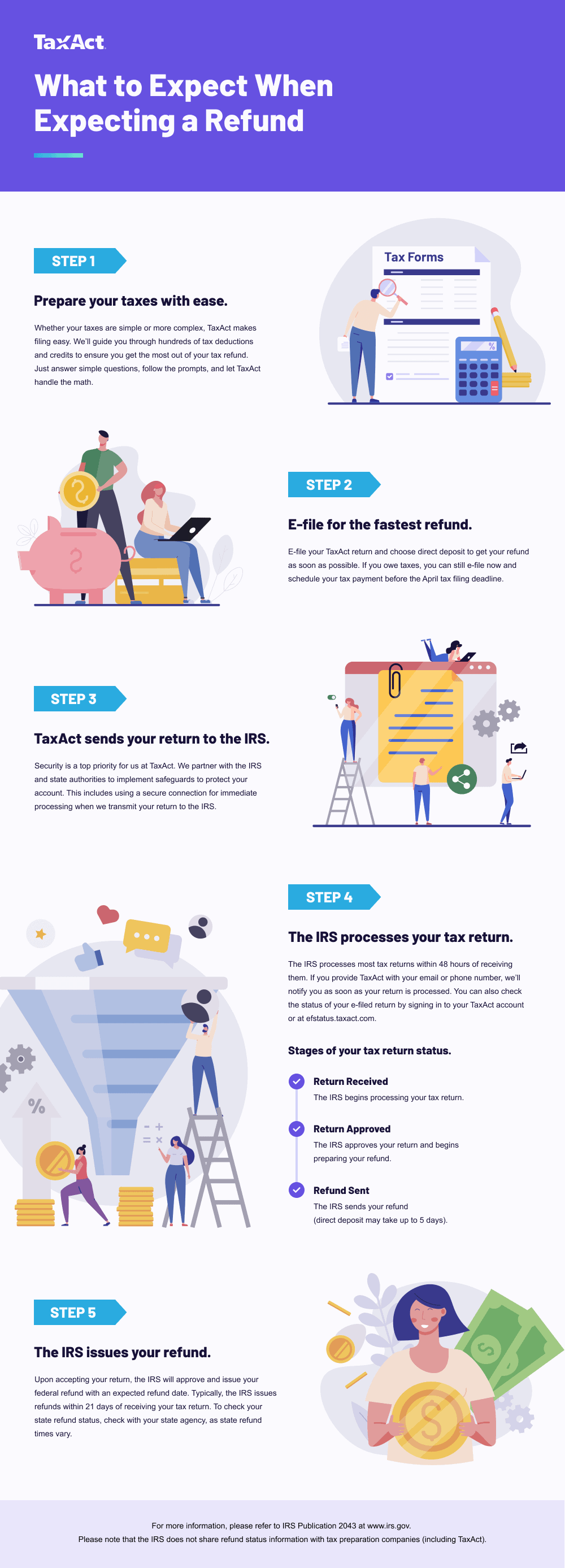

Once the IRS receives your income tax return, the wait for your tax refund begins. While you’re expecting your tax refund, here are the steps that have to happen before your refund gets to you.

How to check your tax refund status

Anxious to have that refund cash in hand? We can help you learn when and how to track the status of your tax refund.

There are three main ways to track your tax refund: the “Where’s My Refund?” official online tool by the IRS, the IRS2Go mobile app, and the IRS TeleTax System reachable at 1-800-829-4477.

The time it takes to track a tax refund depends on your filing method. If you e-filed your income tax return, you can typically check your tax refund status within 24 hours; however, paper filers must wait four weeks after mailing their return before accessing online or mobile app updates. If you want to use the IRS TeleTax System after paper filing, the IRS advises you to wait at least four weeks before checking by phone.

The refund process is divided into three stages:

- Return Received

- Refund Approved

- Refund Sent

If issues arise, the “Where’s My Refund?” tool may direct you to contact the IRS for more information. E-filers opting for direct deposit usually receive their refunds in under three weeks, whereas paper filers may need to wait six to eight weeks. To receive your tax refund quickly and efficiently, opt for electronic filing over mail-in filing and direct deposit over receiving a mailed check.

Your tax refund may be delayed if the IRS notices any inaccuracies or incomplete information in your income tax return. Common errors include typos, math errors, and missing signatures, to name a few. These issues can interrupt the processing of tax returns, leading to longer wait times. Filing an amended return to correct any of these errors can further extend the process.

The IRS discourages unnecessary inquiries about refunds due to high call volumes and advises taxpayers to refrain from calling with questions about their tax refund unless directed to do so or if it has been over 21 days since e-filing.

How do I get my tax refund faster?

Want to get your tax refund ASAP? There are ways to expedite your tax refund.

Firstly, filing your taxes early enhances the speed of your refund. The sooner the IRS receives your income tax return, the sooner they can start processing it, which means your tax refund will be processed sooner as a result.

Another way to ensure you receive your refund quickly is to e-file. TaxAct makes the e-filing process straightforward by guiding you through claiming tax deductions and tax credits that apply to your situation and pulling all the necessary tax forms during the e-filing process. Opting for electronic filing significantly accelerates the refund process compared to mailing a paper return, which can take up to six to eight weeks for the IRS to process.

Direct deposit is another key element to getting your tax refund quickly. The IRS reports that 8 out of 10 taxpayers utilize this method, with over 9 out of 10 direct deposit refunds processed in less than 21 days. When filing with TaxAct, you can choose the direct deposit option — all you’ll need to do is provide the appropriate routing and account numbers, obtainable from a paper check or online banking.

If you’re curious about when you might get your tax refund or its current status, the IRS website allows e-filers to monitor their refund status within 24 hours of submitting your tax refund. Typically, refunds are processed within 21 days. If it has been more than 21 days, you can log onto the IRS website and input your Social Security number, filing status, and refund amount to look up your refund status. Alternatively, after waiting at least four weeks, you can call the IRS TeleTax System at 1-800-829-4477. In both cases, you’ll need to provide the IRS with necessary identification details to accurately look up your tax refund.

The key to expediting your tax refund is a prompt filing, preferably through electronic means, and opting for direct deposit. Together, these factors will typically contribute to a smoother and faster tax refund process.

Why is my tax refund taking so long?

Certain factors determine how quickly you get your tax refund and when you can expect to see that money hit your bank account. Let’s talk about your tax refund timeline after you hit the submit button on your income tax return.

Once you’ve filed your tax return, the waiting game begins, and various factors influence when the IRS will issue your tax refund. If you e-filed your income tax return through TaxAct or another tax software provider, you can typically expect to receive your tax refund within 21 days. The process begins with the IRS accepting your return, initiating the refund processing and the 21-day countdown.

To track your refund, you can use the IRS’s “Where’s My Refund?” tool, but you must wait 24 hours after e-filing to do so. Have your Social Security number, filing status, and exact refund amount on hand for verification. If you filed a paper return, you must wait four weeks before checking your refund status. You can also use the IRS2Go mobile app or call the automated refund hotline at 800-829-1954 to track your tax refund.

Several reasons might delay your tax refund beyond the usual 21 days. These include mailing in a paper tax return, making errors on your tax return, submitting an incomplete return, being a victim of fraud or identity theft, claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), your return needing further review, or filing Form 8379, Injured Spouse Allocation, which can take up to 14 weeks to process. Any of these scenarios can extend IRS processing times and subsequently delay your tax refund.

Remember, to expedite the receipt of your tax refund, e-file your income tax return and opt for direct deposit, as paper checks take longer to issue. Ensure there are no typos in names or numbers and verify that all information on your tax return is accurate and complete before submitting. This not only helps in receiving your refund faster but also reduces the likelihood of errors that could further delay the process.

How to wisely spend your tax refund

Did you get a nice chunk of change for a tax refund this year? Here are some ways to invest your tax refund money and put it to good use.

- Save it.

Consider stashing the money in a savings account or emergency fund to have cash on hand for unexpected expenses. Explore options like a health savings account (HSA) for tax-free savings on medical costs. Financial experts recommend saving three to six months of expenses for an emergency fund. If you go this route, you might want to opt for a high-yield savings account or certificates of deposit (CDs) due to current inflation.

- Pay down debt.

If you have high-interest loans or credit card debt, think about using your tax refund to pay them off faster. Prioritize debts with the highest interest rates to save more money in the long run.

- Boost your retirement.

Another option is to invest in your future by directing your tax refund towards retirement savings, such as a traditional IRA or Roth IRA. Be aware of contribution limits to avoid additional taxes, and keep in mind that contributions can be made until the tax filing deadline.

- Invest it.

Consider expanding your investment portfolio by putting your tax refund into stocks, crypto, bonds, or tangible assets like gold coins. Keep in mind the tax implications, including reporting capital gains or interest.

- Open a 529 plan.

If you have children or relatives in need of college savings, investing in a 529 plan is a great way to save for education expenses. These funds are tax-free when used for qualified educational purposes.

- Give a gift.

If you’re financially secure and want to benefit someone else, gifting is a good way to spend your tax refund. In 2023, you can gift up to $17,000 in a year without paying taxes, and larger gifts can fall under the IRS’s lifetime exclusion. Remember to report gifts exceeding $17,000 through a gift tax return.

With these options, you have several smart ways to invest your tax refund based on your financial goals. Whether it’s building an emergency fund, paying off debt, saving for retirement or education, or giving back through gifting, just make sure to choose the strategy that aligns with your long-term financial well-being.

Boost your retirement with your tax refund

If you’ve recently received a hefty tax refund, you might be contemplating various ways to spend it, such as a relaxing getaway or upgrading your home appliances and wardrobe. However, consider a longer-lasting investment in your future — compound interest, which can significantly boost your retirement.

Whether you’ve encountered it through credit card debt or enjoyed its benefits through investments, you’re likely familiar with the power of interest over time. Investing a lump sum wisely can leave a lasting impact on your financial well-being.

One effective way to utilize your tax refund for retirement is to pay down high-interest debt. While not a traditional investment, reducing credit card debt is an investment in yourself. The interest on credit cards usually surpasses the stock market’s rate of return, making it financially advantageous to pay off such debts early.

You could also consider putting your refund into a Health Savings Account (HSA), especially if you have a high-deductible health plan. HSAs offer tax advantages on medical costs, with tax-deductible contributions, tax-free growth, and withdrawals for qualified medical expenses. Unlike other accounts, there’s no “use it or lose it” policy, and you have full ownership of the money.

Another strategy is to maximize your Roth IRA contributions. Roth IRAs allow you to store extra cash post tax, so the amount grows tax-free. With fewer restrictions than other retirement tools, Roth IRAs permit penalty-free withdrawals of contribution amounts for any reason at any time.

If your employer doesn’t offer a 401(k), investing in a traditional IRA can also be beneficial. While it involves pre-tax funds, meaning you’ll pay taxes upon withdrawal, IRAs come with various tax benefits. Your IRA is like a sushi wrapper — you can fill it with different investments based on what you’re hungry for. Depending on your risk tolerance, you can choose from stocks, bonds, mutual funds, ETFs, or other market tools.

If you want to expand your portfolio even further, you could try investing in tangible assets such as gold. We go over this option in more detail in our article Is It Crazy to Buy Gold Coins for Investments?.

Using your tax refund in one of these ways can significantly enhance your retirement savings. These strategies can provide a solid foundation for long-term financial security and ensure that your money works for you over time.

The bottom line

Remember, your tax refund is not just a once-a-year event; it’s an opportunity to improve your financial well-being. Take the knowledge you’ve gained here and start making the most of your hard-earned money.

For more insights and assistance with your tax-related questions, be sure to explore our other related articles and resources linked on this page.