Products You May Like

Did you receive Form 1099-G this tax year? Here’s everything you need to know about this important tax form and how to use it when filing your income tax return with the Internal Revenue Service (IRS).

At a glance:

- Form 1099-G most commonly reports unemployment compensation plus any state or local tax refunds you received.

- You can receive a 1099-G for other reasons as well.

- TaxAct can help you determine how to report your 1099-G payment if necessary.

What is 1099-G used for?

IRS Form 1099-G, Certain Government Payments, is a tax form used to report income you received from government sources. The most common reason you’d receive this form is if you collected unemployment benefits, but there are other reasons, too. It can also report other payments from a government agency, such as a state or local tax refund or a payment from the Agricultural Payments Program. In many cases, you may need to report 1099-G payments on your tax return.

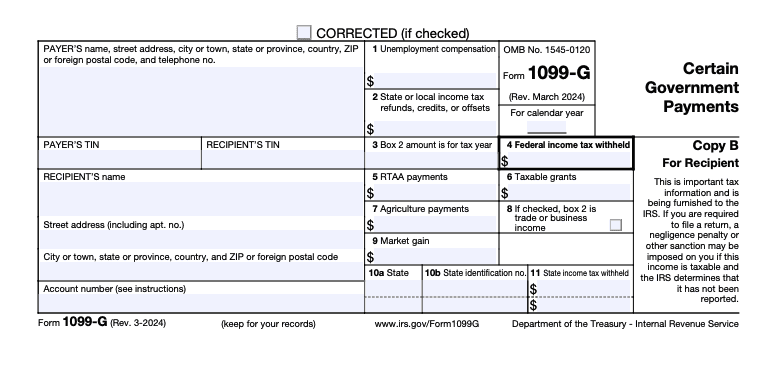

Example of Form 1099-G

Here’s a 1099-G example so you can see what the tax form looks like:

A 1099-G form covers various types of income you might have received from the government. Here’s what you might find on the form:

- Unemployment compensation (Box 1): If you received unemployment benefits during the tax year, the total amount will be listed here. Unemployment compensation is taxable income, so the IRS definitely wants to know about it.

- State or local income tax refunds, credits, or offsets (Box 2): If you got a tax refund, offset, or credit from your state or local government, it might be listed here. However, you typically only need to report this income if you previously claimed a federal deduction for paying those taxes (in the year indicated in Box 3) and if that deduction actually reduced your federal taxes.

- Federal income tax withheld (Box 4): If any taxes were withheld from your unemployment benefits or other payments, you’ll see the amount here. This can be a bit of a silver lining — it means you’ve already prepaid some of your tax bill.

- RTAA payments (Box 5): This shows any reemployment trade adjustment assistance (RTAA) payments you received. RTAA is a wage supplement for certain people who lost their jobs due to foreign trade.

- Taxable grants (Box 6): Any taxable grants you received from government agencies are listed here.

- Agricultural payments (Box 7): For those involved in farming, any payments received from the Department of Agriculture would appear in this box. Box 9 also shows market gains on certain loan types available exclusively to farmers.

Form 1099-G instructions

Here’s what you need to do once you have your 1099-G form in hand:

- Review the form carefully: Double-check all the details on your Form 1099-G. Make sure your name, Social Security number, and the amounts listed are accurate. If you notice any discrepancies, like a payment amount that seems way off or income you never received, contact the issuing agency right away. It could be a mistake or, worse, a sign of identity theft.

- Report the income on your tax return: The income reported on your 1099-G may need to be included on your federal tax return. Not to worry, TaxAct can help you with this (scroll to the last section for detailed instructions on how to do so).

- Consider state-specific guidance: Each state may have its own 1099-G requirements, depending on the type of government payment you received. Make sure to follow any specific 1099-G state guidance from your state’s tax authority (TaxAct can help you with this if you file your state income tax return with us).

- Keep the form for your records: After you’ve reported the income on your tax return, don’t just toss the 1099-G in the recycling bin. Keep it with your tax records for at least a few years. You won’t need to send the form to the IRS when you file, but you’ll want to have it on hand in case they come back with any questions.

FAQs about Form 1099-G

Why did I receive a 1099-G for money I never claimed?

If you received a 1099-G for money you never claimed, it’s possible that someone else filed for unemployment or other benefits in your name. The government saw an uptick in fraudulent claims during the pandemic, and it can still happen, so it’s essential to review your Form 1099-G carefully.

If you suspect identity theft, it’s important to act quickly. Contact the issuing agency immediately to report the error and follow up with the IRS to ensure your tax return reflects the correct tax information. The US Department of Labor has a website for victims of unemployment fraud, so start there. Then, contact the state agency that issued the 1099-G and request a revised form.

Don’t just toss a fraudulent form aside and hope it goes away — because it won’t. The IRS will still expect you to report the income listed on the form unless you take steps to correct it. You can read more about tax identity theft here.

Are 1099-K and 1099-G the same?

No, Form 1099-K and Form 1099-G are not the same, although it’s easy to mix them up. Both forms may report income you received from sources other than your normal salary. A 1099-K form reports income from payment card transactions or third-party network transactions. For example, a third party like PayPal® or Etsy® may send you a 1099-K if you received money through their platform. Meanwhile, a 1099-G form only reports payments made to you by the government.

How to File Form 1099-G with TaxAct

TaxAct can help you file your 1099-G. How you input this tax form in our software depends on what kind of government payment you’re dealing with. Since unemployment compensation and state and local tax refunds are the most common, we’ve compiled 1099-G requirements for those scenarios and how to report them in TaxAct below.

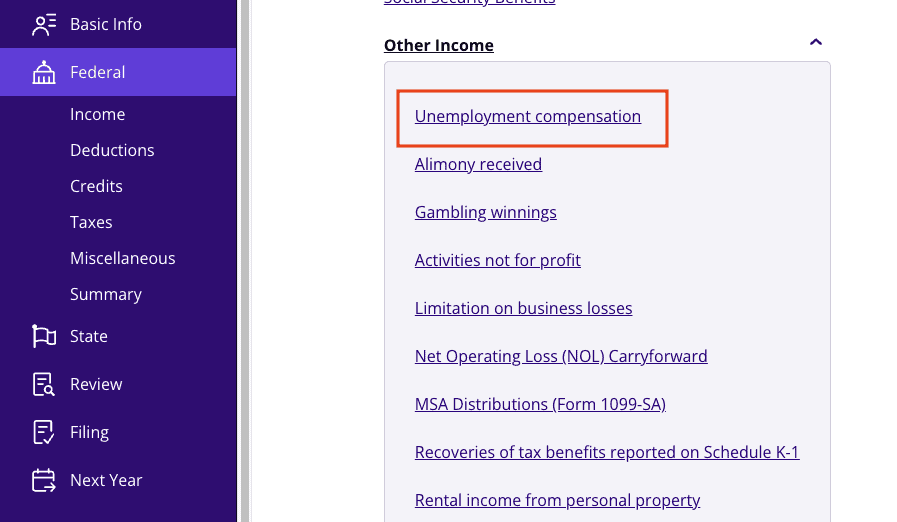

1099-G: Unemployment compensation

If you received unemployment income, it will be in Box 1 of Form 1099-G, which you must report during tax filing. To report this information using TaxAct®:

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

- Click the Other Income dropdown, then click Unemployment compensation.

3. Click + Add Form 1099-G Unemployment to create a new copy of the form or click Edit to edit a form already created. (Desktop program: click Review instead of Edit).

4. Continue with the interview process to enter your information.

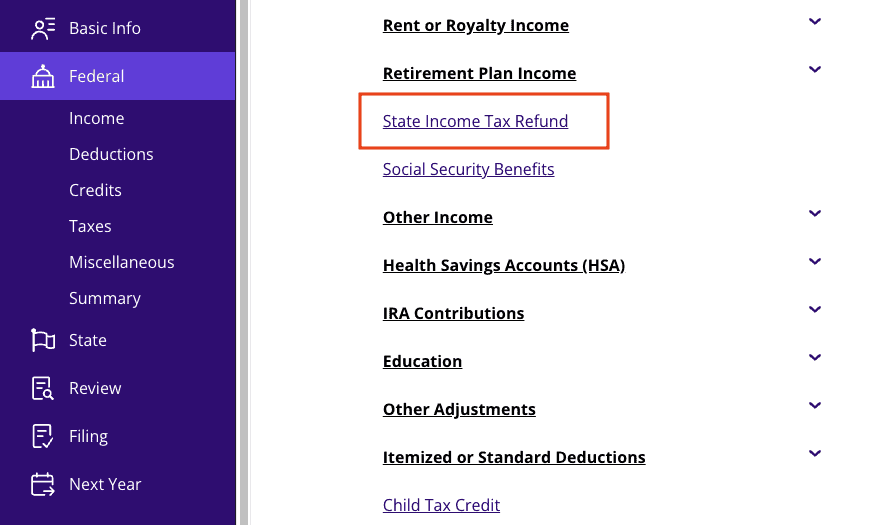

1099-G: State tax refunds

If your employer withholds state taxes and you itemized deductions, you can deduct your state taxes on your IRS return. If these withholdings exceed your actual state tax, you get a refund.

For example, say your employer withheld $5,000 in state income taxes, but you only owe $3,000 in state taxes. In that case, you would get a $2,000 tax refund from the state. However, let’s say you itemized your deductions and deducted $5,000 in state taxes on your federal income tax return. In this case, the $2,000 refund might be taxable on next year’s federal return, depending on how much you benefited from the deduction. If you didn’t benefit from deducting state income tax or took the standard deduction, you don’t need to report the amount in 1099-G Box 2.

Note: If box 8 on your 1099-G is checked, it means the reported amount is related to your business.

If you’re unsure, TaxAct can help determine whether your state tax refund needs to be reported. To report Form 1099-G in the TaxAct program:

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

- Click State Income Tax Refund.

3. Click + Add Form 1099-G State Refund Document to create a new copy of the form, or click Edit to edit a form already created. (Desktop program: click Review instead of Edit).

4. Continue with the interview process to enter your information.

The bottom line

Form 1099-G is an important taxpayer document, so don’t throw it away! By understanding what it is, why you received it, and how to report it on your tax return, you’ll be well on your way to a smooth and stress-free tax season. And remember, if you ever need help, TaxAct can guide you through every step of the process.