Products You May Like

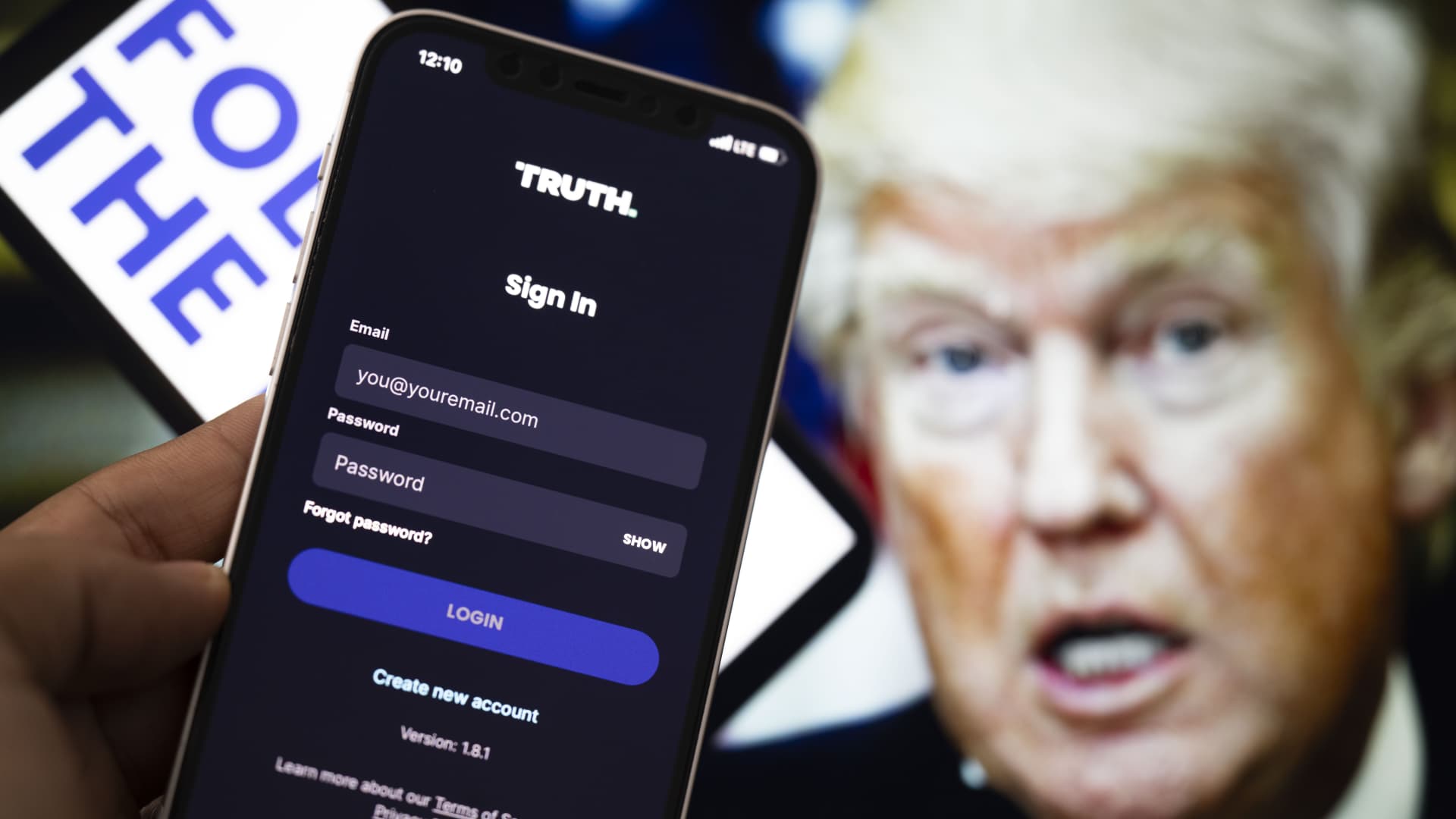

Shares of Trump Media fell more than 10% on Tuesday, a day after the Truth Social app owner reported a net loss of $327.6 million on just $770,500 in revenue in the first quarter of 2024.

Trump Media, whose majority shareholder is former President Donald Trump, revealed the loss in its first earnings report since its stock began public trading under the DJT ticker in March through a merger with a shell company.

The loss for the three-month period ending in March equates to a net loss of $3.61 per share attributable to common stockholders, according to the earnings report.

The report attributed Trump Media’s loss to non-cash expenses, including “the conversion of promissory notes, and the associated elimination of prior liabilities,” that preceded its merger with Digital World Acquisition Corp.

Trump Media said that the bulk of its scant revenue came through its “nascent advertising initiative.”

“At this early stage in the Company’s development, TMTG remains focused on long-term product development, rather than quarterly revenue,” its said in the earnings report.

The company’s share price has whipsawed since it began trading publicly in late March. After scraping a high of more than $79 per share in its debut, the stock suffered a weekslong slide that erased the majority of its gains.

In recent weeks, however, the share price has partially recovered, and as of Tuesday morning hovered around $44.

Despite the company’s lack of significant revenue, it currently boasts a market capitalization of roughly $6 billion.

This is breaking news. Please check back for updates.