Products You May Like

Vehicle miles traveled (VMT) taxes are the road funding tool of the future. For decades, the gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline.

proved to be a reliable user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them.

that funded road construction and maintenance, and consumers paid for their road usage via gasoline taxes when they filled up at the pump. Unfortunately, gas taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues.

Decline in Gasoline Consumption Is Eroding Gas Tax Revenue

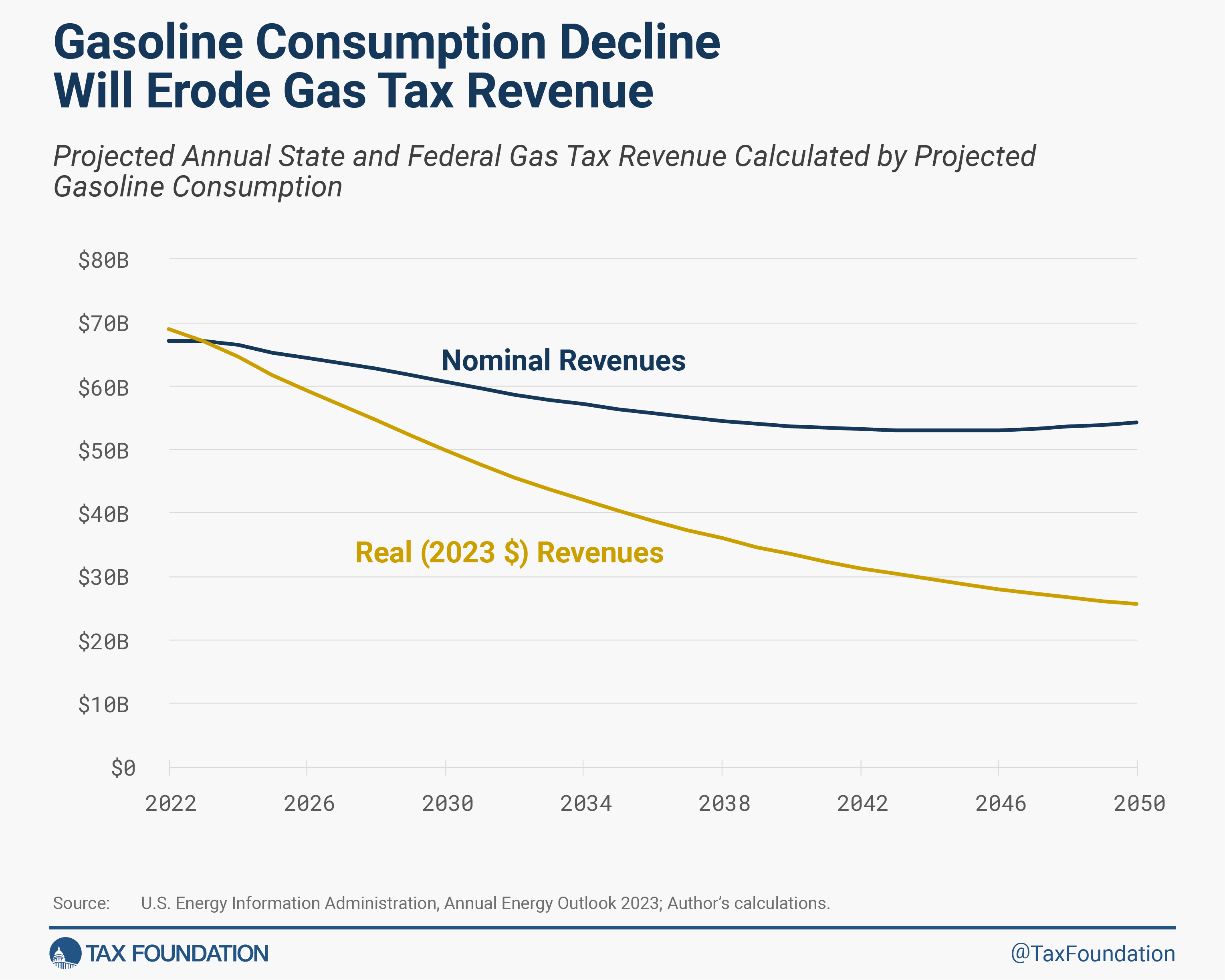

In 2023, Americans drove more miles than ever before. However, real revenues from gas taxes have been falling. Figure 1 shows that real gas tax revenues are projected to contract by more than half of their current level over the next 20 years and fall to nearly a third of their current level by 2050.

While Americans continue to drive farther—increasing the demand for road expenditures—vehicles on the road consume less gasoline per VMT today than ever before. Electric vehicles (EVs) comprise a growing market share and combustion engines are more fuel efficient than ever. These innovations are remarkable achievements that create widespread benefits. When combined with gas tax rates that have not kept pace with inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

, however, the result is that gas tax revenues have become increasingly insufficient to cover roadway expenses.

Exploring an Efficient Solution

An efficient solution would be to replace the existing system of gas taxes, registration fees, and other miscellaneous surcharges with a VMT tax. Such taxes are also called mileage-based user fees, road usage charges, or something similar, but they are all user fees that strive to establish a better road funding mechanism by aligning use with costs.

A VMT tax is a charge that drivers pay per mile they drive on public roads, which may vary based on the vehicle’s weight per axle and/or the time and location of the driving. Instead of using gas consumption as a proxy for road use, a VMT tax would measure actual road use and then charge the driver for each mile driven. If accurately calibrated, this would reconcile roadway revenues and expenditures, eliminate the redistributive effects of the gas tax, and insulate road funding from changing efficiencies, technologies, or consumer preferences. With deficits only increasing, change is needed sooner rather than later.

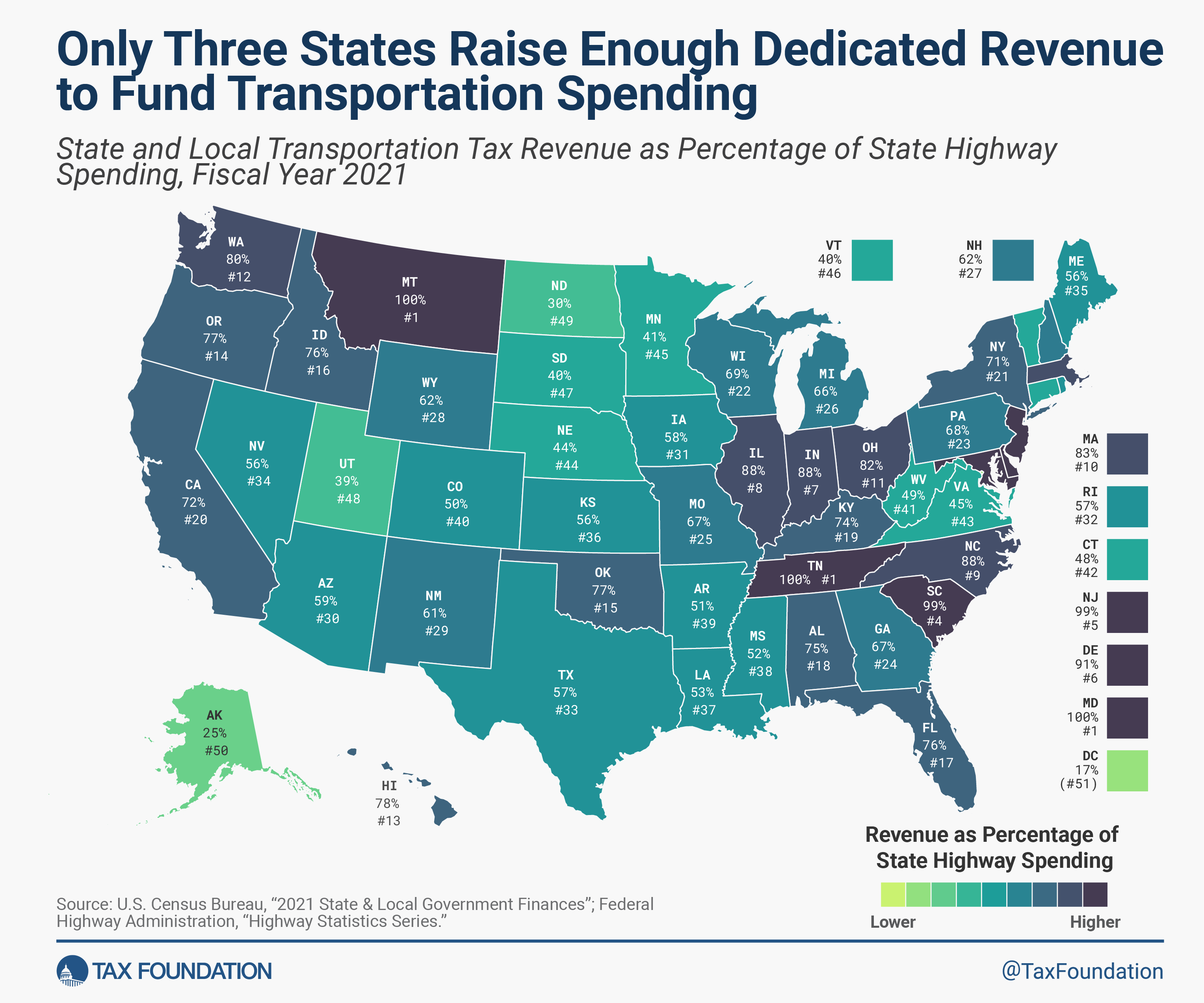

Currently, only three states can fully fund their share of road spending with transportation revenues. In other states, the remaining funds must be diverted from more general revenue sources. This means that non-drivers are forced under the current system to subsidize drivers and pay for roads that they do not use. It also means that other areas of spending must work with less after bearing the extra burden of roadway deficits.

Gas taxes are also regressive. Vehicles with lower fuel efficiency pay more per mile driven, subsidizing the vehicles with better fuel efficiency which are often newer and more expensive, even if these vehicles do no less damage to road surfaces. Electric vehicles don’t consume gasoline at all. Rural drivers tend to drive lower gas mileage vehicles, so they generally subsidize urban drivers. Heavy vehicles also cause much more damage to the roads, but existing fuel taxes fail to capture this extra wear and tear beyond the very imperfect proxy of fuel efficiency. This means that drivers of light vehicles, like passenger cars, must subsidize heavy vehicles with their gas taxes.

A VMT tax could eliminate the need for states to divert general funds to road spending and would have that road spending furnished entirely by those who drive on them. A VMT tax would establish a more neutral fee for road usage, while insulating road funding from continual changes to fuel efficiencies, vehicle types, and consumer preferences.

Considering the Trade-Offs

Properly designing and implementing a VMT tax is not so easy, however. Policymakers must counterbalance simplicity with effectiveness, weighing the administrative costs of the system against the road use accuracy of a VMT measure. They must also consider the very legitimate privacy concerns the public has with government trying to track their driving and must design a system within the bounds of the Constitution (issues have been raised that could preclude mandatory GPS tracking as violative of the 4th, 9th, and 14th Amendments).

Low technology options for VMT monitoring include manual submissions of odometer readings (quarterly or annually as part of a state’s existing inspection or registration process), time, and/or mileage permits. More advanced technologies include plug-in devices and smartphone apps, similar to those already available for use in insurance markets (e.g., Progressive’s Snapshot and State Farm’s Drive Safe & Save).

More accurate tracking of vehicles could be more expensive to implement and risk a greater invasion of privacy but would enable proper apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders.

of funds based on the location of the driving. To help protect privacy, states operating VMTs rely on private-sector commercial account managers (CAMs) such as Azuga and Emovis. Data from individual users is sent directly to the CAMs. That data is then stripped of nonessential information and passed onto government agencies with only the information necessary for tax purposes (e.g., aggregate miles driven on public roads).

Once operational, VMTs have even broader applications. VMTs can vary road prices based on time and demand, incorporating congestion-based pricing into the VMT tax. This system would better capture externalities from driving but add more complexity to the system.

State Coalitions and Case Studies

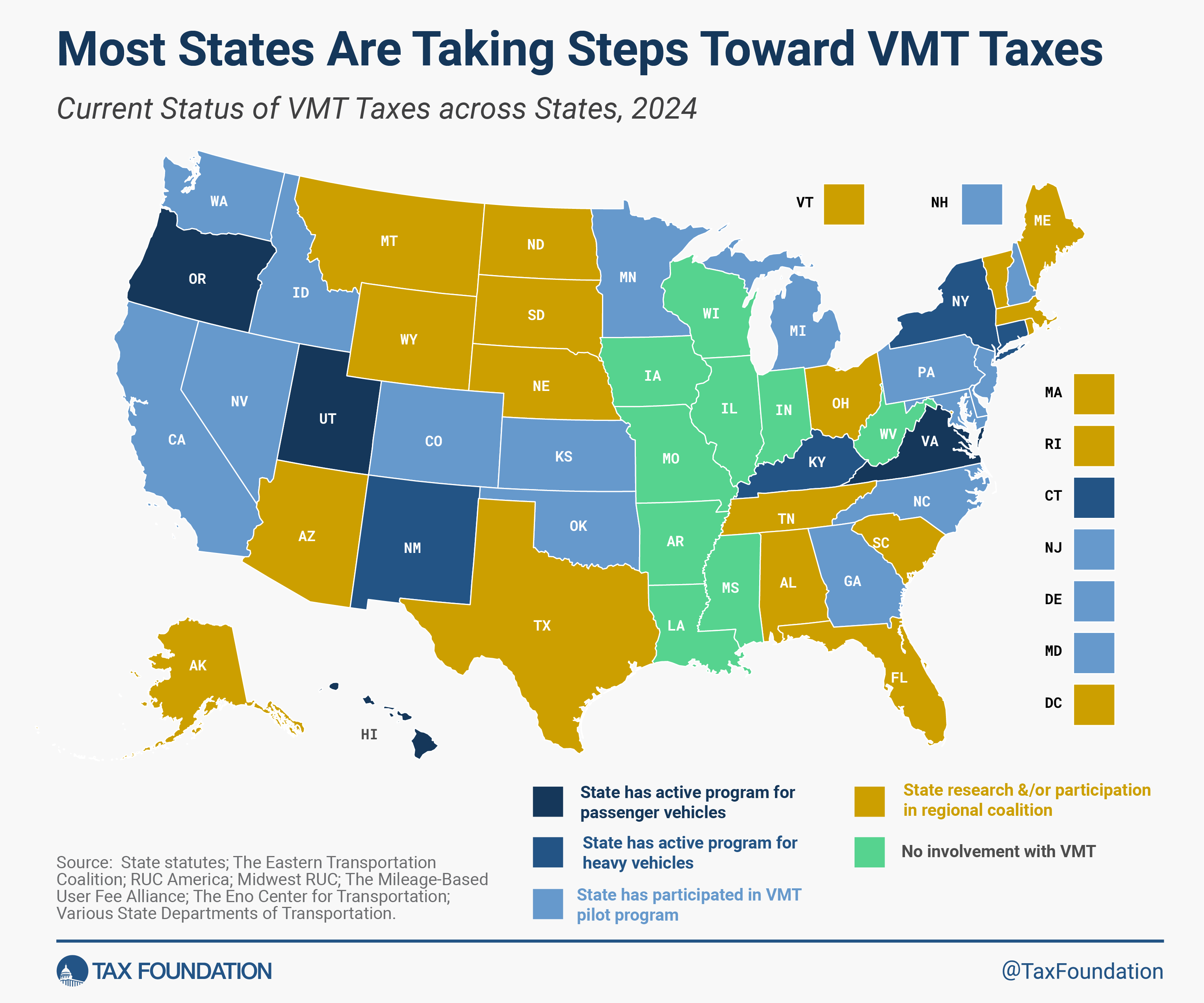

Coordinating and tracking road use across state lines is another challenge for VMTs. Regional partnerships allow states and other key decision-makers to work together to research, design, and implement road user fees. The Eastern Transportation Coalition brings together 20 eastern states on all manner of transportation projects, including mileage-based user fees, and Road Usage Charge America brings together 20 states specifically to research and advance road user fees.

Oregon was the first state to begin research into VMT taxes in 2001 and was the first to implement a program in 2015. Four states now have active programs for passenger vehicles and four other states have active programs targeting heavy commercial vehicles (Oregon has both), with pilot programs carried out in 16 states. Only Hawaii has a mandatory program, which requires EVs to participate by 2028 and all light vehicles by 2033.

Pricing varies by state. Drivers of a vehicle with an MPG greater than 20 can enroll in Oregon’s OReGO system, which offers GPS or non-GPS tracking methods, credits for out-of-state driving using GPS, and prices per mile at $0.02. Only EV drivers can enroll in Utah’s Road Usage Charge (RUC) to pay $0.016 per mile, tracked with an OBD device and a smartphone app—which includes location data but does not exempt out-of-state driving or private roads. Drivers of fuel-efficient vehicles in Virginia may enroll in the Mileage Choice Program to pay a variable rate based on MPG (up to $0.0107 per mile for EVs), tracked with or without GPS but never with exemptions for private roads or out-of-state driving. Hawaiian EV drivers can enroll in their RUC next year, paying $0.008 per mile as recorded by an annual odometer reading.

States have also tried various incentives for participation in these voluntary programs. Typically, VMT participants’ charges are capped at the amount they would have been charged through the state’s alternative system (e.g., Viginia’s Highway Use Fee or alternative EV registration fees). This allows some participants—those that use the roads very little—to pay less in total taxes and fees. Also, VMT participants are able to spread their payment out over the entire year, as opposed to having to pay a one-time registration fee, and some participants, typically those in pilot programs, are given a small financial payment for participating.

A Principled Vehicle for Roadway Funding

The consensus from the assorted state studies, pilots, and programs is that VMT taxes work and they do not need to be overly complex or invasive. Highway deficits will continue to grow without reform to the gas tax. A VMT tax would establish the price of a mile, allowing revenues to be reconciled with costs, while simultaneously decreasing the regressive, distortionary, and redistributive effects of the current system.

An ideal VMT system would be coordinated across all 50 states or through a federal system. Several challenges may complicate the transition from gas taxes to VMTs. Notably, state-by-state rollouts of VMTs without a federal system will leave open opportunities for “free-riders”—(out-of-state) users of the road who don’t pay into the state VMT. Patchwork regional coalitions and expanded toll systems can help bridge this gap to avoid a kind of transitional gains trap.

In time, VMT taxes can efficiently replace the existing structure; VMT taxes shouldn’t be seen as an add-on to the existing system. A VMT tax can be a simple, transparent, neutral, and stable “vehicle” for roadway funding.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share