Products You May Like

The Biden administration announced on Wednesday new actions to protect renters across the U.S., including trying to curb practices that prevent people from accessing housing and curtailing exorbitant rent increases in certain properties with government-backed mortgages.

A “Blueprint for a Renters Bill of Rights” was included in the announcement. It lays out a collection of principles for the federal government and other entities to take action on, including “access to safe, quality, accessible and affordable housing” and “clear and fair leases.”

“Having the federal government and the White House talk about the need for and endorse a renters’ bill of rights is really significant,” said Diane Yentel, president and CEO of the National Low Income Housing Coalition.

More from Personal Finance:

Tax filing season is here. How to get a faster refund

Gen Xers carry the most credit card debt, study shows

Here’s what it takes to get a near-perfect credit score

Over 44 million households, or roughly 35% the U.S. population, live in rental housing, according to the White House.

While the coronavirus pandemic led to a wave of new renter protections and aid measures, including a historic pot of rental assistance for those who’d fallen behind, most of that help has dried up by now.

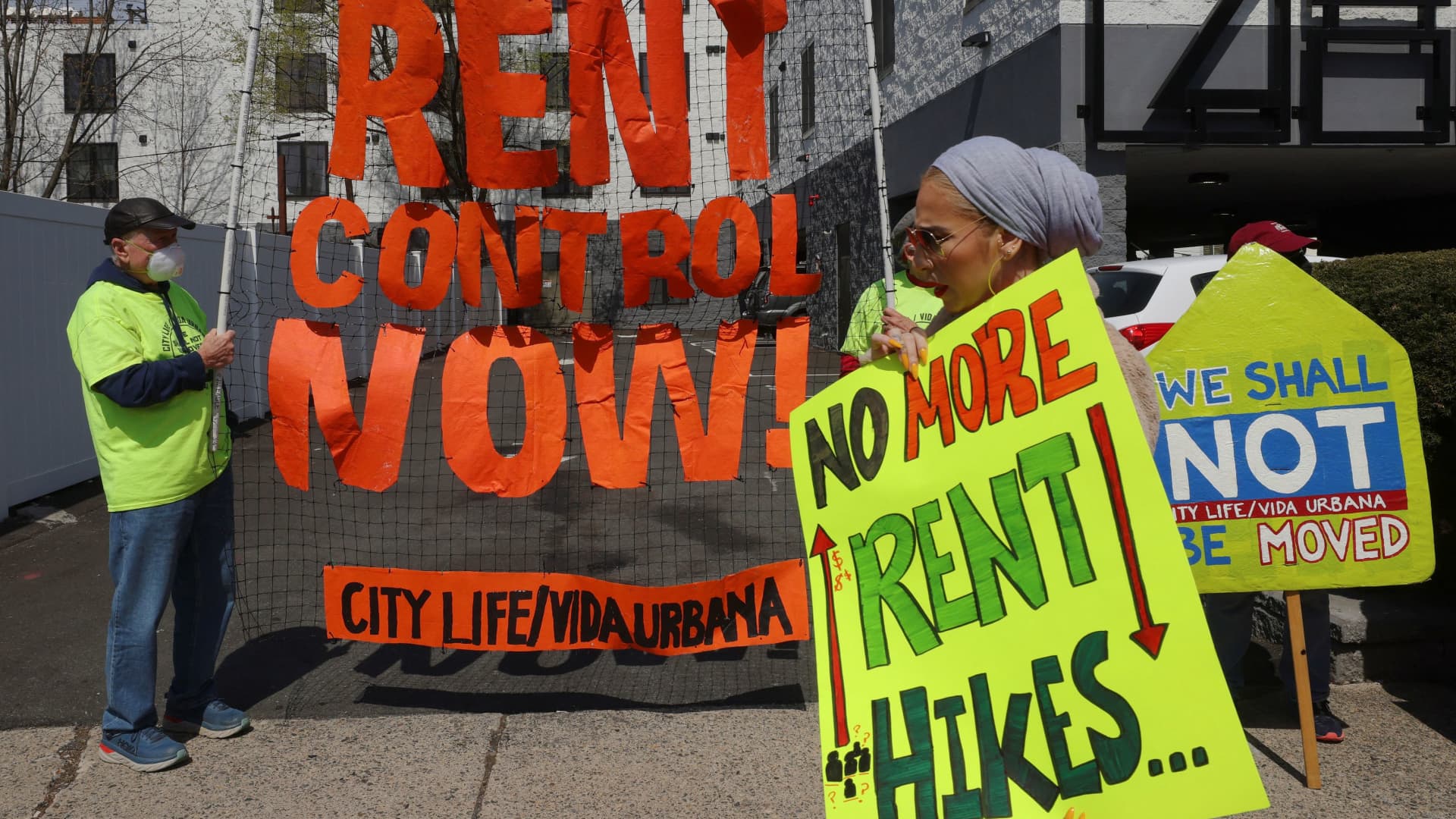

Advocates have long called on the government to respond to an affordability crisis facing renters. Nearly half of renter households in the U.S. direct more than 30% of their income to rent and utilities each month, and 900,000 evictions occurred annually prior to the public health crisis.

Possibly curbing ‘egregious rent increases’

As part of Wednesday’s announcement, the Federal Housing Finance Agency and federal mortgage giants Fannie Mae and Freddie Mac say they will look into possibly establishing tenant protections that limit “egregious rent increases” at properties backed by certain federal mortgages.

More than 28% of the national stock of rental units are federally financed, according to a calculation by the Urban Institute in 2020.

Rent protections on such properties “would be the most significant action the federal government could take,” Yentel said.

As part of the White House actions, the Federal Trade Commission said it will look into ways to expand its authority to take action against practices that “unfairly prevent consumers from obtaining and retaining housing.”

The persistence of eviction information on certain background reports, as well as high application fees and security deposits, are some of these practices, Yentel said.

The U.S. Department of Housing and Urban Development also said it will move toward requiring certain rental property owners to provide at least 30 days notice if they plan to terminate the lease of a tenant due to nonpayment of rent. The agency will award $20 million for the Eviction Protection Grant Program, which will fund nonprofits and government agencies to provide legal assistance to low-income tenants at risk of eviction.

Bob Pinnegar, president and CEO of trade group the National Apartment Association, said the industry opposed expanded federal involvement in the landlord-tenant relationship.

“Complex housing policy is a state and local issue and the best solutions utilize carrots over sticks,” Pinnegar said.

‘Aggressive administrative action is so important’

Although the steps announced by the Biden administration are historic, they won’t resolve the U.S. housing crisis, Yentel said.

What’s needed to address the deep issues, she said, is building more affordable housing, creating permanent emergency and universal rental assistance, and establishing robust tenant protections.

However, Yentel added, since it’s “hard to see where the opportunities for those investments will come from this Congress, aggressive administrative action is so important.”