Products You May Like

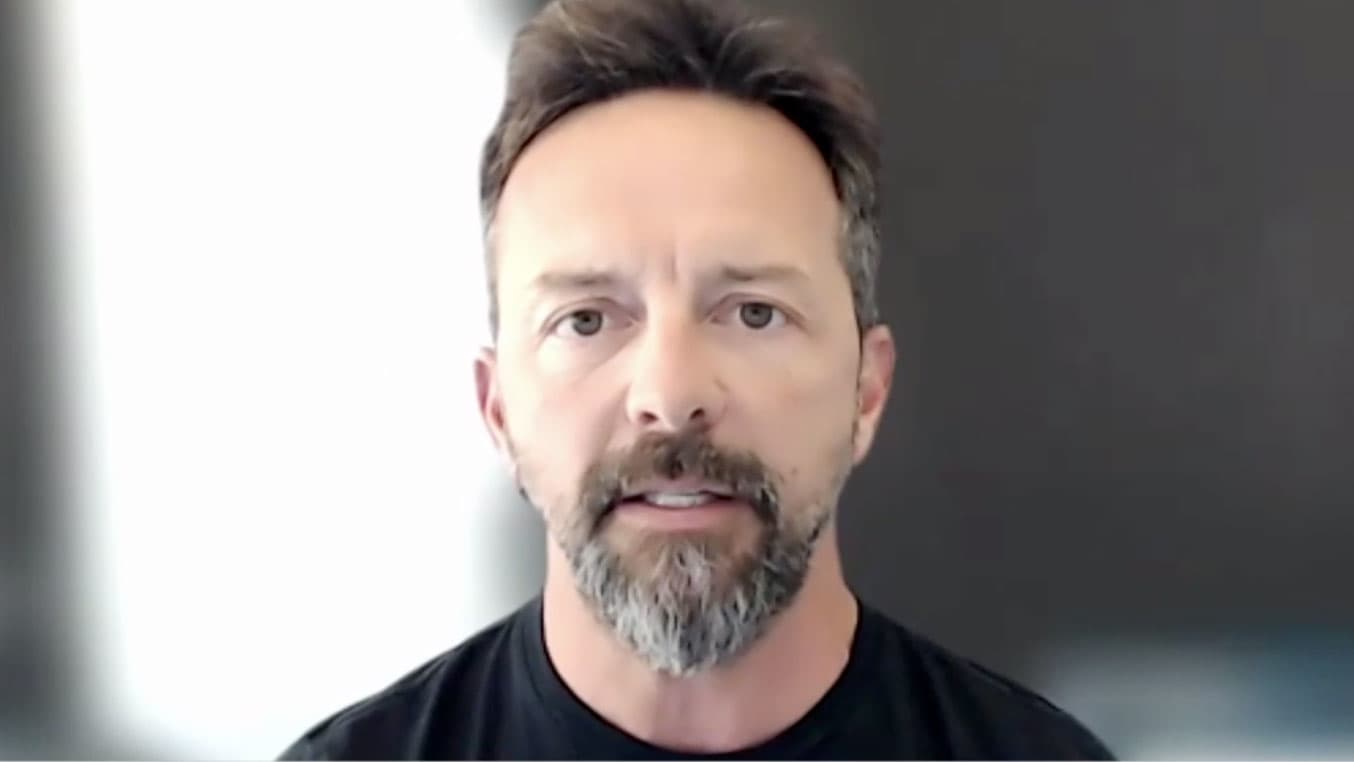

Brad Gerstner, Altimeter Capital Chairman and CEO, said his hedge fund sold stakes in United Airlines and Expedia, adding that easy gains from the rebound in travel stocks have been realized.

“On July 1 this year after a big run-up in United and Expedia, we distributed those returns to investors…. I still think the travel stocks will be fine… there will be some winners and losers but easy gains off the Covid bottom have certainly been made,” Gerstner said Wednesday at CNBC’s Delivering Alpha conference.

At the end of the second quarter, Altimeter owned $150 million worth of United shares and $60 million worth of Expedia stock, according to InsiderScore.com. Shares of United gained 13% year to date, while Expedia shares jumped 27% in 2021.

The investor said he expects interest rates and stock growth multiples to normalize to January 2020 levels as the world recovers from the Covid crisis. He revealed that his hedge fund’s net long exposure has been reduced to 50% from 90% last year.

Gerstner said he’s still long cloud company Snowflake, which remains his hedge fund’s largest holding. He said he bought into pandemic winners Zoom Video and Peloton after they pulled back from Covid highs.

The hedge fund also cut back its exposure to China significantly amid the heightened regulatory pressure and crackdown on the tech industry.

Gerstner said the only China stake his hedge fund has is internet company and TikTok owner ByteDance. He exited his sizeable positions in Pingduoduo and Alibaba at the end of 2020.

“This is a fundamentally different moment,” Gerstner said. “I don’t think you are going to see additional Chinese IPOs in the United States. All Chinese companies are going to be directed to the Hong Kong exchange. This is a period of, if nothing else, radical uncertainty about the future path.”

Beijing is stepping up its oversight on the flood of Chinese listings in the U.S., vowing to overhaul the overseas listing system and tighten restrictions on cross-border data flows and security.