Products You May Like

Did you purchase an electric vehicle (EV) recently? Many EVs, plug-in hybrid electric vehicles (PHEVs), and fuel cell vehicles (FCVs) can score you a nice tax break. Let’s see if you qualify and, if so, how to claim this tax credit.

What is the electric vehicle tax credit?

Officially called the Qualified Plug-In Electric Drive Motor Vehicle Credit, the EV tax credit was designed as a tax incentive to reward taxpayers for purchasing more eco-friendly vehicles.

Depending on what type of new EV you buy and its battery capacity, the EV tax credit can be worth up to $7,500. But only certain EVs, PHEVs, and FCVs qualify for the tax credit.

Can I claim the electric vehicle tax credit for a used car purchase?

Beginning in tax year 2023, used EVs purchased from licensed dealerships may also be eligible for the clean vehicle credit, up to a maximum of $4,000.

Do I get the EV tax credit if I get a refund?

The clean vehicle credit is non-refundable, meaning it can reduce your tax liability to $0, but if your tax credit exceeds the tax you owe, the excess won’t be refunded to you.

EV tax credit requirements

Qualifying vehicles

Not all electric cars are equal in the eyes of the IRS. Qualifying vehicles must meet specific criteria, which underwent many changes with the Inflation Reduction Act passed in 2022. We discuss which vehicles qualify in How Will Buying an EV Affect My Taxes?

The IRS also has a list of qualified manufacturers for clean vehicle tax credits (note that not all clean vehicles made by the manufacturers on this list are guaranteed to qualify for the credit).

Clean vehicle credit income limits

Your vehicle isn’t the only thing that needs to meet specific requirements — you do, too. The EV tax credit is available to individuals and businesses who meet the following requirements:

- You didn’t buy the vehicle for resale purposes.

- You mainly use the vehicle within the U.S.

Your modified adjusted gross income (MAGI) also plays a role in your eligibility. These are the current EV income limits:

- $300,000 for married couples filing jointly or a surviving spouse

- $225,000 for heads of households

- $150,000 for all other filers

If it helps you qualify, you can opt to use your AGI from the year before you took delivery of the vehicle. For instance, let’s say you’re a joint married filer who bought an EV in 2023 and your AGI for 2023 was $350,000. However, in 2022, your AGI was only $275,000, putting you under the $300,000 limit for married couples filing jointly. In this case, you can use your 2022 income to qualify for the EV tax credit, even though you were over the AGI limit in the year you took delivery of the vehicle.

How to claim the EV tax credit with TaxAct

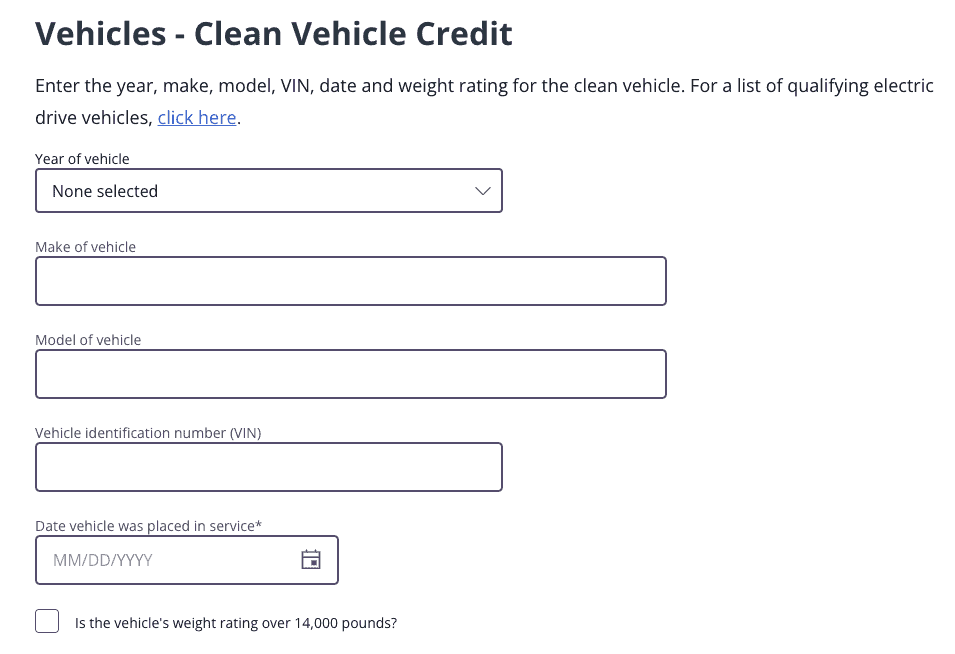

To claim the EV tax credit, you’ll need to file Form 8936, the Qualified Plug-in Electric Drive Motor Vehicle Credit form. Let’s break down the steps for claiming this credit while using TaxAct® to file your income tax return.

Step 1: Navigate to Form 8936

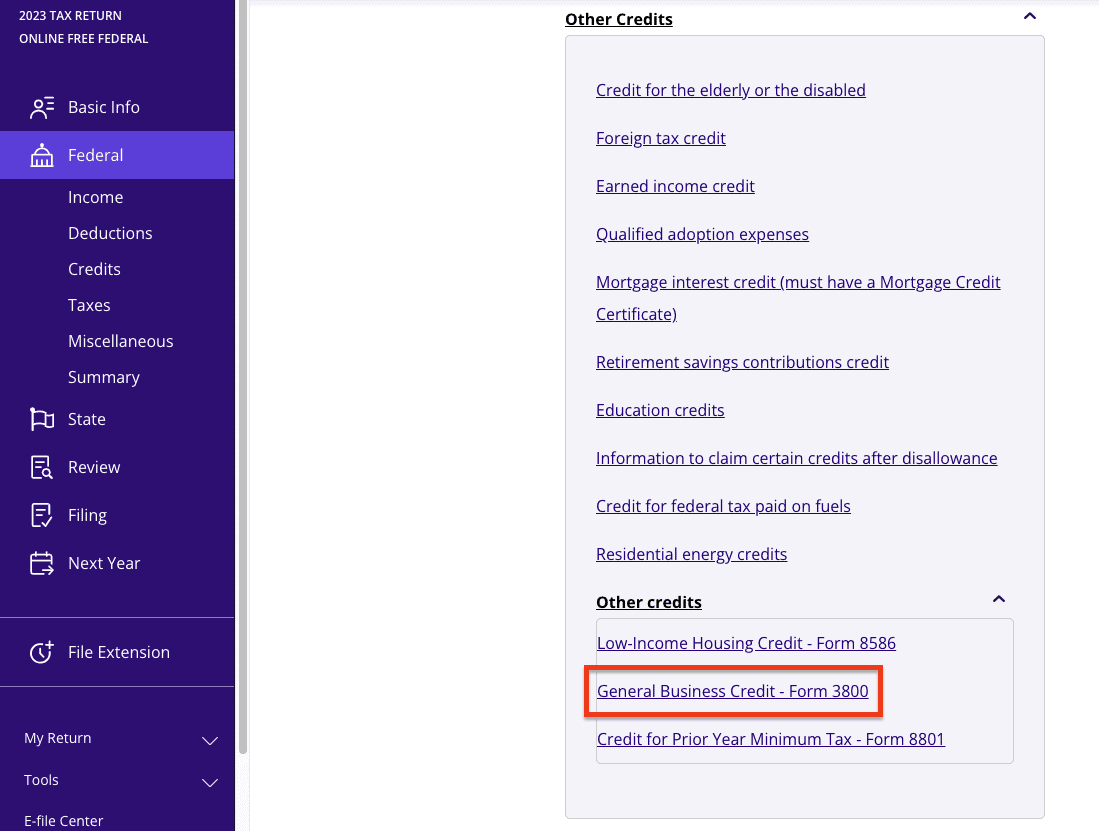

- Within your TaxAct return (see screenshots below), click Federal. On smaller devices, click the icon in the top left corner, then click Federal.

- Click the Other Credits

- Another dropdown will appear — click the Other credits dropdown again.

- Now, click General Business Credit – Form 3800.

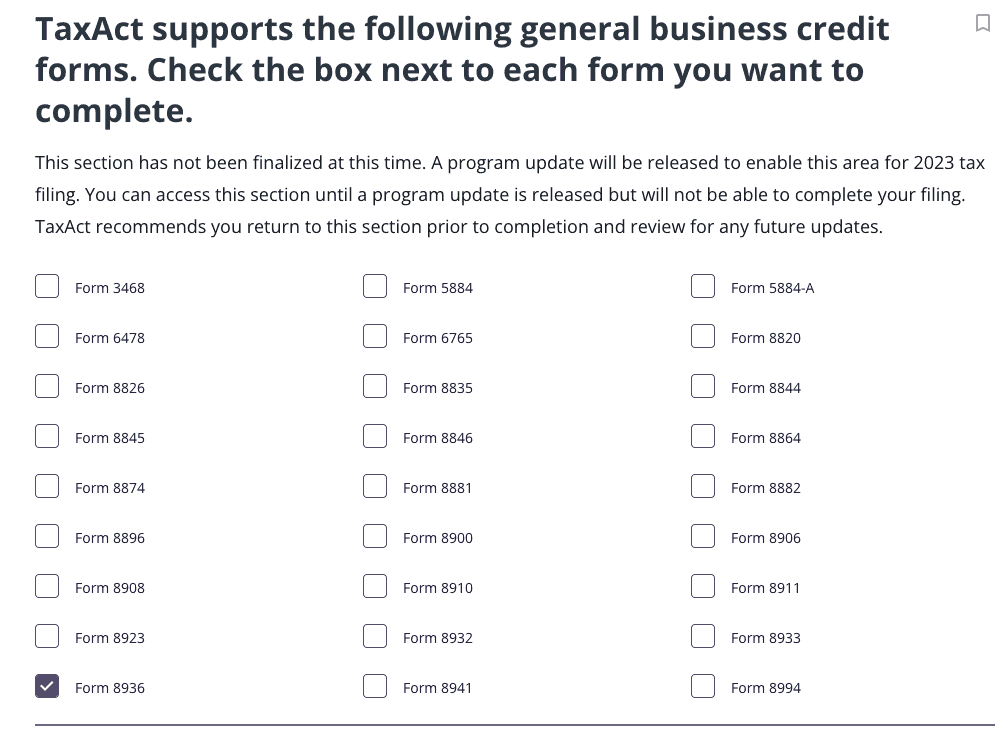

Step 2: Select Form 8936

- Spot Form 8936 in the list and click the checkbox.

2. Continue with the interview process to enter your vehicle information.

And that’s it!

Claim the clean vehicle credit with TaxAct.

Now that you know how to claim the EV tax credit, it’s time to try it out for yourself. Start filing your income tax return with TaxAct today, and we’ll help you claim the EV tax credit with ease.