Products You May Like

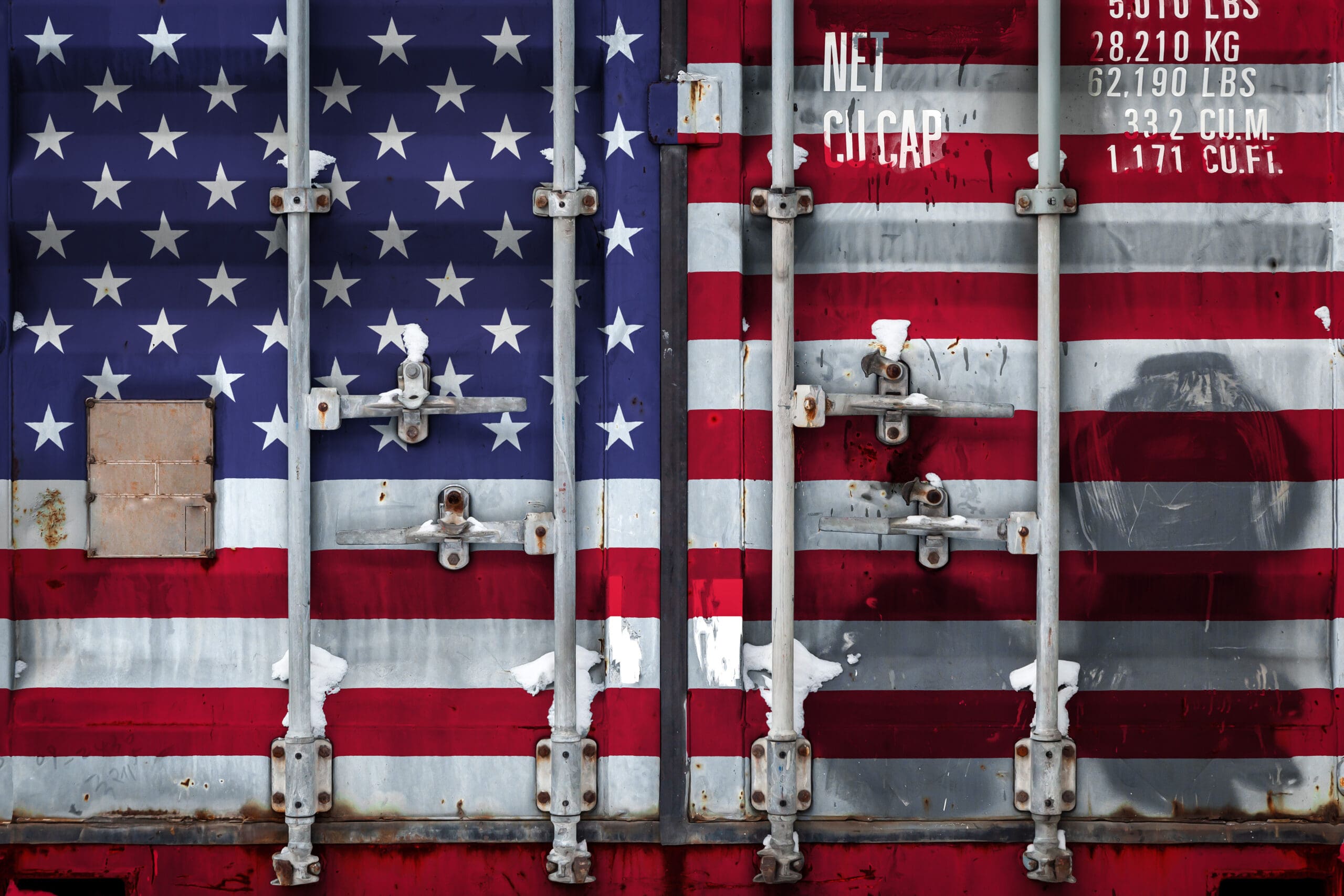

In his first term, President Donald Trump began a trade war by imposing nearly $80 billion worth of new import taxes, or tariffs, on a broad range of goods Americans buy from overseas businesses. Now as a candidate, Trump has proposed even more tariffs that would potentially apply to every single import purchase Americans make. What do tariffs mean for American consumers and businesses buying foreign goods, and what about American businesses selling their own products to foreigners?

Import tariffs are taxes levied on goods entering a country. They are collected at customs and are paid by the importing business or individual. So, when Americans import goods from foreign countries, they pay foreign exporters for the goods and pay the US federal government an additional taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

based on the “tariffTariffs are taxes imposed by one country on goods or services imported from another country. Tariffs are trade barriers that raise prices and reduce available quantities of goods and services for U.S. businesses and consumers.

rate” assigned to that specific import.

Sometimes politicians impose tariffs to try to protect domestic businesses, because making imports more expensive through a higher tax also makes domestic goods comparatively more desirable. However, tariffs have significant consequences. Higher prices for American businesses and consumers are just the tip of the iceberg. Counterintuitively, placing a tax on imports is economically like placing a tax on exports. We identify four ways import tariffs can hurt exporters: misallocation of resources, higher production costs, currency appreciation, and foreign retaliation.

How Do Tariffs Affect Resource Allocation?

Tariffs make domestic products more attractive by raising the prices of foreign products. To the uninitiated, that might sound like a good thing. Won’t that create more jobs here because it increases production at home? Not so fast.

Placing a tax on imports absolutely shifts more business toward domestic companies that formerly struggled to compete with lower-priced imports. But that shift toward higher-priced domestic goods comes at a cost to others. What if we posed the tax question another way—should we place a tax on the products US firms export to the rest of the world? This probably sounds like a bad idea. Won’t it hurt jobs and production? What if we told you a tax on imports and a tax on exports ultimately have a similar effect on the US economy?

Economist Doug Irwin illustrates the sameness of both taxes through an example of a clothing manufacturer and an aircraft manufacturer. Placing tariffs on clothing imports would cause domestic clothing prices to rise. At higher prices, more domestic firms would be attracted to producing clothing, and more investment would flow toward domestic clothing manufacturing. That would pull resources away from the aircraft manufacturing sector, which becomes relatively less attractive than the tariff-protected clothing sector. Now, imagine instead of a tariff applied to clothing imports, the government placed an export tax on aircraft: the same reallocation away from aircraft manufacturing and toward clothing would also happen because the policy has the same effect—changing the relative profitability across industries.

Bottom line: When the government imposes a tariff, it redistributes resources away from consumers and unprotected industries toward the protected industry.

How Do Tariffs Affect Production Costs?

We often hear that American consumers will have to pay more for tariffed goods, and that is true. But when we think of American consumers, we shouldn’t just think of a typical person. Many American consumers are businesses. Businesses purchase capital goods, like machinery and tools, as well as intermediate inputs, like steel and wood.

Applying import taxes to intermediate and capital goods has a negative impact on downstream industries—or industries that use such materials to produce their own goods. So while protection may deliver higher production and employment in one industry, it may directly raise the cost of doing business in another industry.

More than half of the US tariffs on imports from China apply to “intermediate goods” used for the production of other goods and services. Higher production costs mean businesses must accept lower profits, increase their prices, or choose a combination of the two, all of which leave businesses worse off and less able to compete in international markets.

In the case of the 2018-2019 tariffs, economists estimated nearly one-fourth of US exporters were subject to tariff increases on at least one product, and those exporters represented more than 80 percent of all exports and 65 percent of manufacturing employment. The implied tax increases from the tariffs amounted to $900 per worker overall and about $1,600 per worker in the manufacturing sector. The researchers found that companies more exposed to import tariffs saw lower export growth, amounting to an export tax of nearly 1.5 percent at the average exposure level, and up to 4 percent for the most exposed firms.

Likewise, a review of the steel and aluminum tariffs found that while production and employment increased for steel and aluminum makers, production and employment decreased by a larger amount in downstream industries that had to pay more for steel and aluminum inputs.

Bottom line: When the government imposes a tariff, it may be trading jobs and production in one part of the economy for jobs in another part of the economy by increasing production costs for downstream industries.

How Do Tariffs Affect Currency Values?

Another way to think about the link between imports and exports is through the foreign exchange market. When tariffs raise the after-tax price of imported goods, demand for the imported goods falls. Lower demand for foreign goods means lower demand for foreign currencies, making the US dollar stronger as a result.

A stronger US dollar may partly counteract the tariffs by making imported products relatively more affordable pre-tax, but it also makes US exports relatively more expensive in international markets, lowering demand for US goods abroad.

Indeed, a study that looked at 151 countries from 1963 through 2014 found that tariff increases lead to real exchange rate appreciation.

Bottom line: Foreign exchange markets link imports and exports, so that when a country imposes a tariff to reduce imports, it also reduces its exports.

How Do Foreign Countries React to New US Tariffs?

When tariffs are imposed on a foreign country, that country commonly retaliates with tariffs of its own. For example, in response to US tariffs imposed in 2018 and 2019, foreign jurisdictions— including Canada, Mexico, China, the EU, India, Russia, and Turkey—imposed tariffs on US exports. Retaliatory tariffs raise the after-tax price of US goods sold internationally. Thus, foreigners are discouraged from purchasing US exports.

Retaliation in response to the 2018-2019 tariffs has had especially negative effects on the agricultural sector, which experienced significant reductions in exports and employment from the trade war. In fact, nearly all of the increased tariff revenue from 2018 through 2020 was used to compensate producers who lost income because of the retaliation.

Bottom line: Retaliatory tariffs may further increase the cost of US exports in foreign markets, costing more jobs at home.

What Should Lawmakers Do?

When lawmakers propose a tax on imports, they should understand that they are indirectly proposing a tax on exports. Reallocating resources toward import-competing sectors, raising costs of production, increasing the value of the dollar, and inviting retaliatory tariffs all burden US exporters and limit their ability to compete in international markets.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share