Products You May Like

Many countries’ personal income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

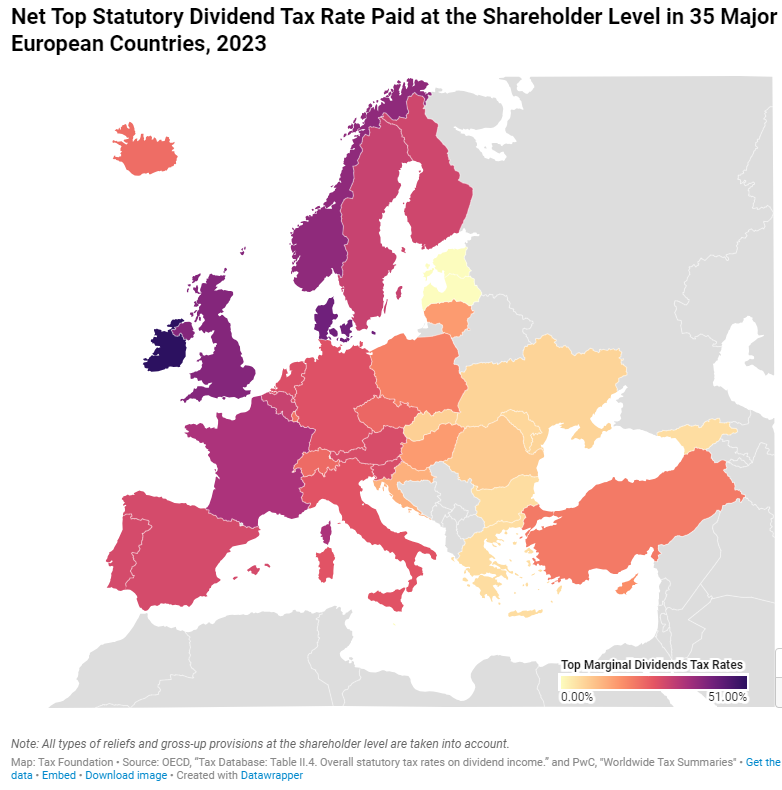

systems tax various sources of individual income—including investment income such as dividends and capital gains. The highest tax rate individuals pay on dividend income differs significantly across European countries.

A dividend is a payment made to a corporation’s shareholders from corporate after-tax profits. In most countries, such dividend payments are subject to dividend tax. The dividend tax rates shown in the accompanying map reflect the top personal dividend tax rate, after accounting for all imputations, credits, or offsets.

Explore our interactive map below to see how your country compares.

Ireland has the highest top dividend tax rate among the covered European countries at 51 percent. Denmark and the United Kingdom follow, at 42 percent and 39.4 percent, respectively.

Estonia, Latvia, and Malta are the only European countries covered that do not levy a tax on dividend income. For Estonia and Latvia, this is due to their cash-flow-based corporate tax system: instead of levying a dividend tax, they levy a corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

of 20 percent when a business distributes its profits to shareholders. Malta, in contrast, allows shareholders to offset personal income tax on their dividend income against its 35 percent corporate tax rate, resulting in a zero percent top rate.

Of the countries that do levy a dividend tax, Bulgaria, Georgia, and Greece have the lowest tax rate at 5 percent, followed by Moldova and Ukraine at 6 percent and 6.5 percent, respectively.

Among the 35 European countries, the average top dividend tax rate is 20.4 percent.

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

at the individual level when that income is passed to its shareholders as either dividends or capital gains. Some countries, however, have integrated their taxation of corporate and dividend/capital gains income to eliminate such double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share

Previous Versions

-

Dividend Tax Rates in Europe, 2022

3 min read

-

Dividend Tax Rates in Europe, 2021

2 min read

-

Dividend Tax Rates in Europe, 2020

2 min read

-

Dividend Tax Rates in Europe, 2019

2 min read