Products You May Like

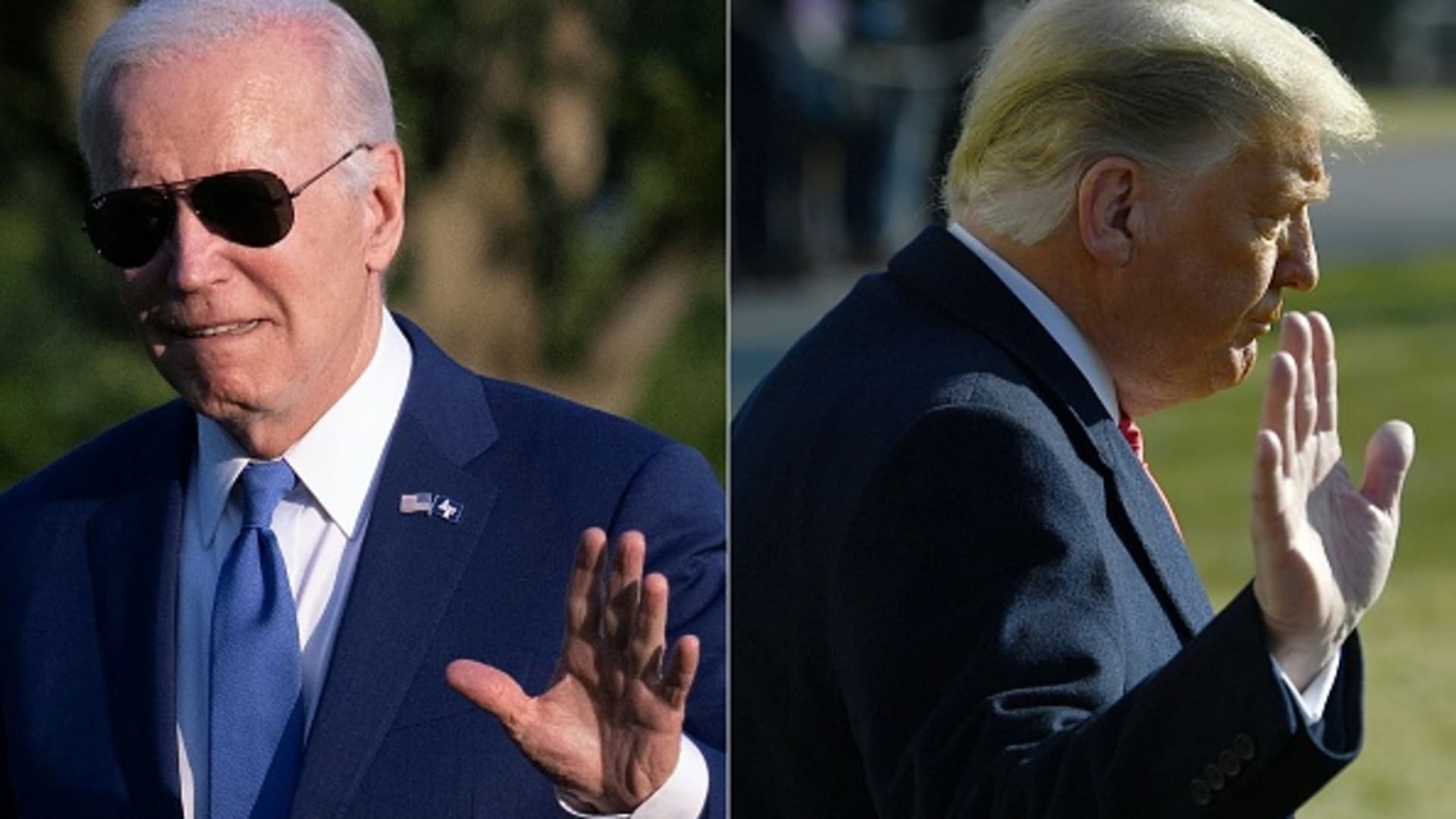

As President Joe Biden and former President Donald Trump secure enough delegates to clinch their party nominations, policy experts are weighing how proposed tariffs could affect American consumers.

While the Trump campaign hasn’t released many tax policy specifics, he has renewed his support for tariffs, which are taxes levied on imported goods from another country.

“I’m a big believer in tariffs,” Trump said Monday on CNBC’s “Squawk Box,” suggesting that he’s likely to reinstitute duties if elected for a second term.

More from Personal Finance:

Nearly half of young adults have ‘money dysmorphia,’ survey finds

19 million people may qualify for free tax prep through the IRS this year

Here’s the inflation breakdown for February 2024 — in one chart

During this first term from 2017 to 2021, Trump added a variety of tariffs to bolster U.S. industries, including levies on China, Mexico and the European Union, among others. The Biden administration has maintained some of those tariffs.

“Here’s an area where the candidates are actually pretty similar — first what Trump imposed and then what Biden maintained,” said Erica York, a senior economist and research manager with the Tax Foundation’s Center for Federal Tax Policy.

“That’s an area to pay attention to,” she added.

How tariffs could affect Americans consumers

While the Biden campaign hasn’t released specifics on tariffs, Trump has proposed a baseline 10% tariff on all U.S. imports and a levy of 60% or higher on Chinese goods.

“That would be a massive escalation in import taxes and have some really negative ramifications,” York said.

For example, a study from the Federal Reserve Bank of New York found that 2018 U.S. tariffs cost the typical household $419 per year.

The 10% tariff would raise taxes on U.S. consumers by more than $300 billion a year and could cause “retaliatory tax increases on U.S. exports from international trade partners,” according to the Tax Foundation.

“When Trump was president, he always talked about China paying this tax, but China doesn’t pay it” because American companies pass the added expense to shareholders, workers and consumers, said Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center.

“If President Trump raises tariffs on imported goods, it means inevitably that American consumers are going to pay more” for both imported and domestic products, he said.

While critics warn that higher tariffs could add to inflation, the consumer price index didn’t exceed the historic average during Trump’s first term.