Products You May Like

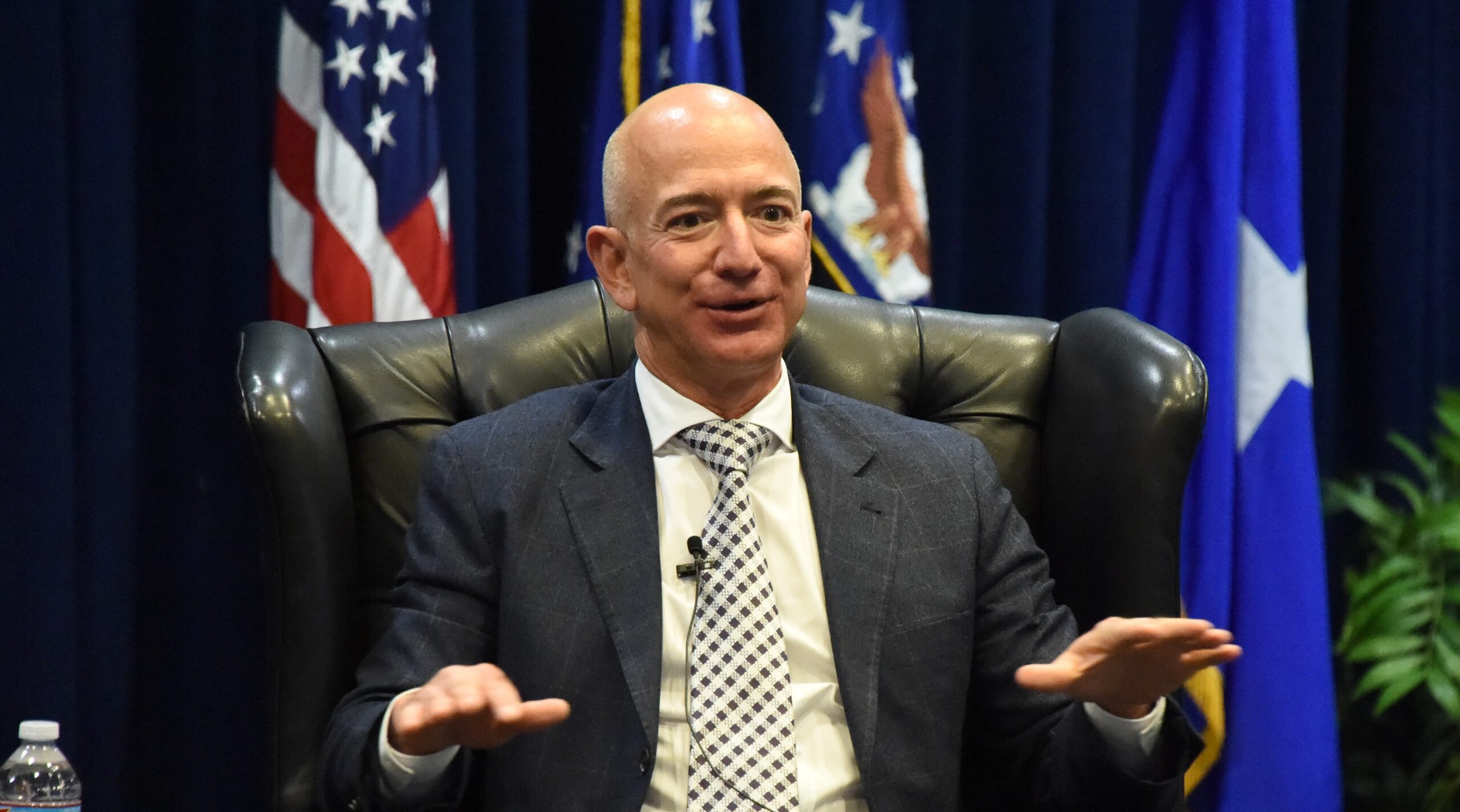

Jeff Bezos announced a move to Miami, and somewhere, a Washington state revenue official was probably moved to tears.

Bezos sold about $15.7 billion worth of Amazon stock between 2020 and 2021, according to news reports. If we assume that Bezos—who, other than the symbolic purchase of one share last year, has not purchased any shares of Amazon in decades—had held onto these shares since the IPO, he saved nearly $1.1 billion in taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

es by selling those shares before the new state capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

went into effect. Whether or not it was a motivating factor, relocating to Florida ensures that future sales won’t be subject to Washington’s new capital gains tax, either.

Meanwhile, Washington officials have spent recent years bandying about wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary.

proposals. Wealth taxes are uniquely economically damaging—but for those targeted by them at the state level, they can also be fairly easy to avoid. An early version of the wealth tax proposal, exclusively targeting billionaires, would have generated an estimated 97 percent of its revenue from five people from Amazon and Microsoft. The latest proposal, which imposes a 1 percent tax on tradeable net worth above $250 million, has a somewhat larger base—an estimated 700 people in total—but the bulk of the revenue still comes from a small handful of the state’s wealthiest residents.

The state’s economists projected that the wealth tax would raise about $3.2 billion a year once implemented. This estimate included assumptions that some share of high-net-worth households would move to avoid the tax, but a Bezos move is going to be particularly hard for the state to stomach. Based on his current net worth, which is mostly in publicly reported ownership of Amazon shares, Bezos would have been on the hook for about $1.44 billion a year under the proposed wealth tax—a full 45 percent of the projected total.

Again, even though the official estimate tried to account for some outmigration, presumably including some of the state’s wealthiest taxpayers, this is worth repeating: his decision to move to Florida just eliminated potential wealth tax collections worth nearly half the official estimate. When a tax is so heavily concentrated on a few wealthy, highly mobile individuals, that’s what happens when just one person moves. And if the tax were ever adopted, others might follow.

While Bezos may not be thinking about this yet, by moving to Florida, he also shields his heirs from Washington’s highest-in-the-nation estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs.

, with a top rate of 20 percent.

It’s not hard to understand the political appeal of targeting the wealthy for uniquely high levels of taxation. But as many states have learned to their detriment, there is a tipping point where too many of those high earners and high-net-worth individuals are driven away, depriving the state of all their tax revenue, and of the economic activity they otherwise would have bankrolled in the state.

Only Jeff Bezos knows if taxes were on his mind when he decided to move to Florida. Publicly, he has cited wanting to be closer to relatives and his Blue Origin operations. But it’s funny how, whatever reasons billionaires give for their moves, they almost always seem to wind up in low-tax states. (Except Larry Ellison. Maybe he’s proof that at least some billionaires simply don’t care.) And whether tax savings motivated his move or not, the implications for Washington are very real, and serve to illustrate just how dangerous it can be to design tax systems that rely so overwhelmingly on a very small number of taxpayers choosing to stay put.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share