Products You May Like

When the Supreme Court struck down the Biden administration’s student loan forgiveness plan at the end of June, it dealt a crushing blow to the president as he runs for reelection and to the tens of millions of Americans who were promised the financial relief.

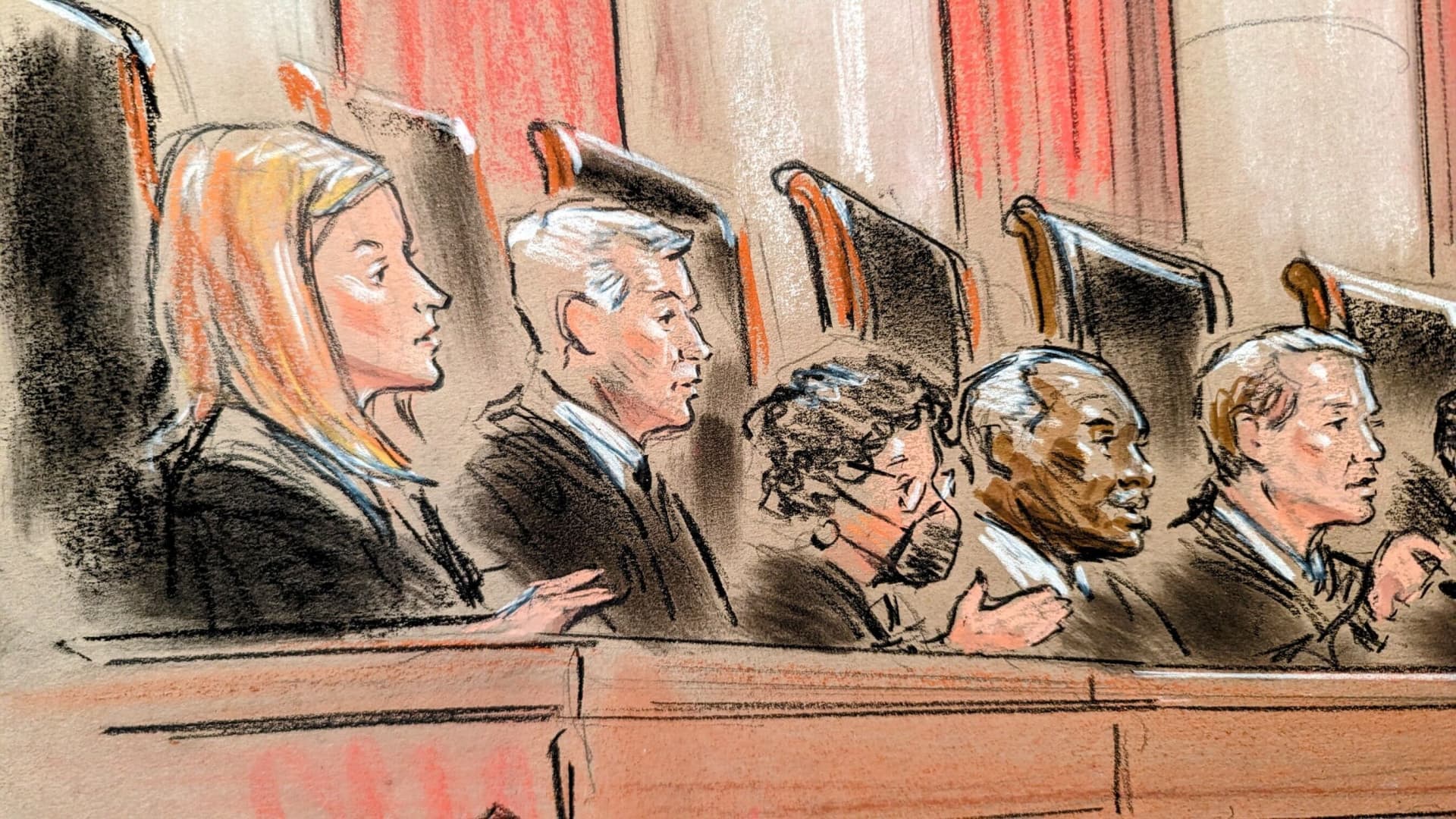

Unsurprisingly, the 6-to-3 vote was split on ideological lines. But what else did the justices have to say? How did they reach their conclusion?

Here are two key takeaways.

1. Conservative justices found states had standing

The biggest obstacle for those who wanted to legally challenge President Joe Biden’s student loan forgiveness was showing they’d be harmed by the relief policy, which is typically a requirement to gain the right to sue.

That need to prove so-called legal standing is designed to prevent people from using the judicial system to work out policy differences that are considered more appropriate for elections.

More from Personal Finance:

Here’s the inflation breakdown for June, in one chart

Social Security phone disruptions have led to longer wait times

How to protect your money from inflation

The six GOP-led states — Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina — that were successful in getting Biden’s plan nixed by the justices had argued that the policy would lead to a loss of profits for the companies in their states that service federal student loans.

Chief Justice John Roberts, in the majority opinion for Biden v. Nebraska, wrote that MOHELA, or the Missouri Higher Education Loan Authority, would lose around $44 million a year in fees it earns from servicing federal student loans after Biden’s forgiveness. As a result, Roberts found that at least Missouri had successfully proven legal standing. He said the court didn’t need to consider standing for the other states.

Legal experts and consumer advocates were skeptical that Biden’s plan would reduce MOHELA’s bottom line. They pointed out that the lender’s revenue was actually expected to rise because of some student loan servicers recently leaving the space and it picking up extra accounts.

“I was surprised the court found Missouri had standing,” said higher education expert Mark Kantrowitz. “The debts of MOHELA are not the debts of the state. And MOEHLA is able to sue on its own, so why didn’t it bring its own lawsuit?”

Luke Herrine, an assistant professor of law at the University of Alabama, said he was confused by the fact that Roberts didn’t pay much attention to the issue of standing at all. The requirement has long been defended by conservative justices, especially former Justice Antonin Scalia.

“I don’t think they actually took the standing issues all that seriously,” Herrine said. “And I have no idea if that will be a precedent, or if it’s just a one-off so they could get to the merits, because they didn’t like this case.”

They are classic ideological plaintiffs.Elena Kaganliberal justice

Liberal justice Elena Kagan strongly disagreed that Missouri had standing, pointing out that the lender was financially independent from Missouri, “as corporations typically are.”

“The revenue loss allegedly grounding this case is MOHELA’s alone,” Kagan wrote in her dissent. “The state’s treasury will not be out one penny because of the secretary’s plan.”

“We do not allow plaintiffs to bring suit just because they oppose a policy,” Kagan said.

2. Heroes Act doesn’t allow for broad debt cancelation

When the president rolled out his plan in August 2022 to forgive as much as $20,000 in education debt for tens of millions of Americans, he pointed to the Heroes Act of 2003 as his legal justification. That law was passed in the aftermath of the 9/11 terrorist attacks, and grants the president broad power to revise student loan programs during national emergencies.

The Covid pandemic was such an emergency, the administration said. The U.S. Department of Education warned that the crisis had left millions of borrowers in a worse off financial situation and that there could be a historic rise in delinquencies and defaults without its loan cancellation.

But Roberts took the sides of the states, saying the Heroes act didn’t permit the kind of sweeping student loan forgiveness the president was trying to deliver.

″’Can the Secretary use his powers to abolish $430 billion in student loans, completely canceling loan balances for 20 million borrowers, as a pandemic winds down to its end?'” Roberts wrote. “We can’t believe the answer would be yes.”

Kagan once again disagreed.

“The statute, read as written, gives the secretary broad authority to relieve a national emergency’s effect on borrowers’ ability to repay their student loans,” she said.

In the end, it was the Supreme Court that exceeded its authority, Kagan said.

“The majority overrides the combined judgement of the legislative and executive branches, with the consequence of eliminating loan forgiveness for 43 million Americans,” she wrote.