Products You May Like

Job cuts are rising at some of the biggest U.S. companies, but others are still scrambling to hire workers, the result of wild swings in consumer priorities since the Covid pandemic began three years ago.

Tech giants Meta, Amazon and Microsoft, along with companies ranging from Disney to Zoom, have announced job cuts over the past few weeks. In total, U.S.-based employers cut nearly 103,000 jobs in January, the most since September 2020, according to a report released earlier this month from outplacement firm Challenger, Gray & Christmas.

Meanwhile, employers added 517,000 jobs last month, nearly three times the number analysts expected. This points to a labor market that’s still tight, particularly in service sectors that were hit hard earlier in the pandemic, such as restaurants and hotels.

The dynamic is making it even harder to predict the path of the U.S. economy. Consumer spending has remained robust and surprised some economists, despite headwinds such as higher interest rates and persistent inflation.

All of it is part of the Covid pandemic’s “legacy of weirdness,” said David Kelly, global chief strategist at J.P. Morgan Asset Management.

The Bureau of Labor Statistics is scheduled to release its next nonfarm payroll on March 3.

Some analysts and economists warn that weakness in some sectors, strains on household budgets, a drawdown on savings and high interest rates could further fan out job weakness in other sectors, especially if wages don’t keep pace with inflation.

Wages for workers in the leisure and hospitality industry rose to $20.78 per hour in January from $19.42 a year earlier, according to the most recent data from the Bureau of Labor Statistics.

“There’s a difference between saying the labor market is tight and the labor market is strong,” Kelly said.

Many employers have faced challenges in attracting and retaining staff over the past few years, with challenges including workers’ child care needs and competing workplaces that might have better schedules and pay.

With interest rates rising and inflation staying elevated, consumers could pull back spending and spark job losses or reduce hiring needs in otherwise thriving sectors.

“When you lose a job you don’t just lose a job — there’s a multiplier effect,” said Aneta Markowska, chief economist at Jefferies.

That means while there might be trouble in some tech companies, that could translate to lower spending on business travel, or if job loss rises significantly, it could prompt households to pull back sharply on spending on services and other goods.

The big reset

Some of the recent layoffs have come from companies that beefed up staffing over the course of the pandemic, when remote work and e-commerce were more central to consumer and company spending.

Amazon last month announced 18,000 job cuts across the company. The Seattle-based company employed 1.54 million people at the end of last year, nearly double the number at the end of 2019, just before the pandemic, according to company filings.

Microsoft said it’s cutting 10,000 jobs, about 5% of its workforce. The software giant had 221,000 employees as of the end of June last year, up from 144,000 before the pandemic.

Tech “used to be a grow-at-all-costs sector, and it’s maturing a little bit,” said Michael Gapen, head of U.S. economic research at Bank of America Global Research.

Other companies are still adding employees. Boeing, for example, is planning to hire 10,000 people this year, many of them in manufacturing and engineering. It will also cut around 2,000 corporate jobs, mostly in human resources and finance departments, through layoffs and attrition. The growth aims to help the aerospace giant ramp up output of new aircraft for a rebound in orders with large sales to airlines like United and Air India.

Airlines and aerospace companies were devastated early in the pandemic when travel dried up and are now playing catch-up. Airlines are still scrambling for pilots, a shortage that has limited capacity, while demand for experiences such as travel and dining has surged.

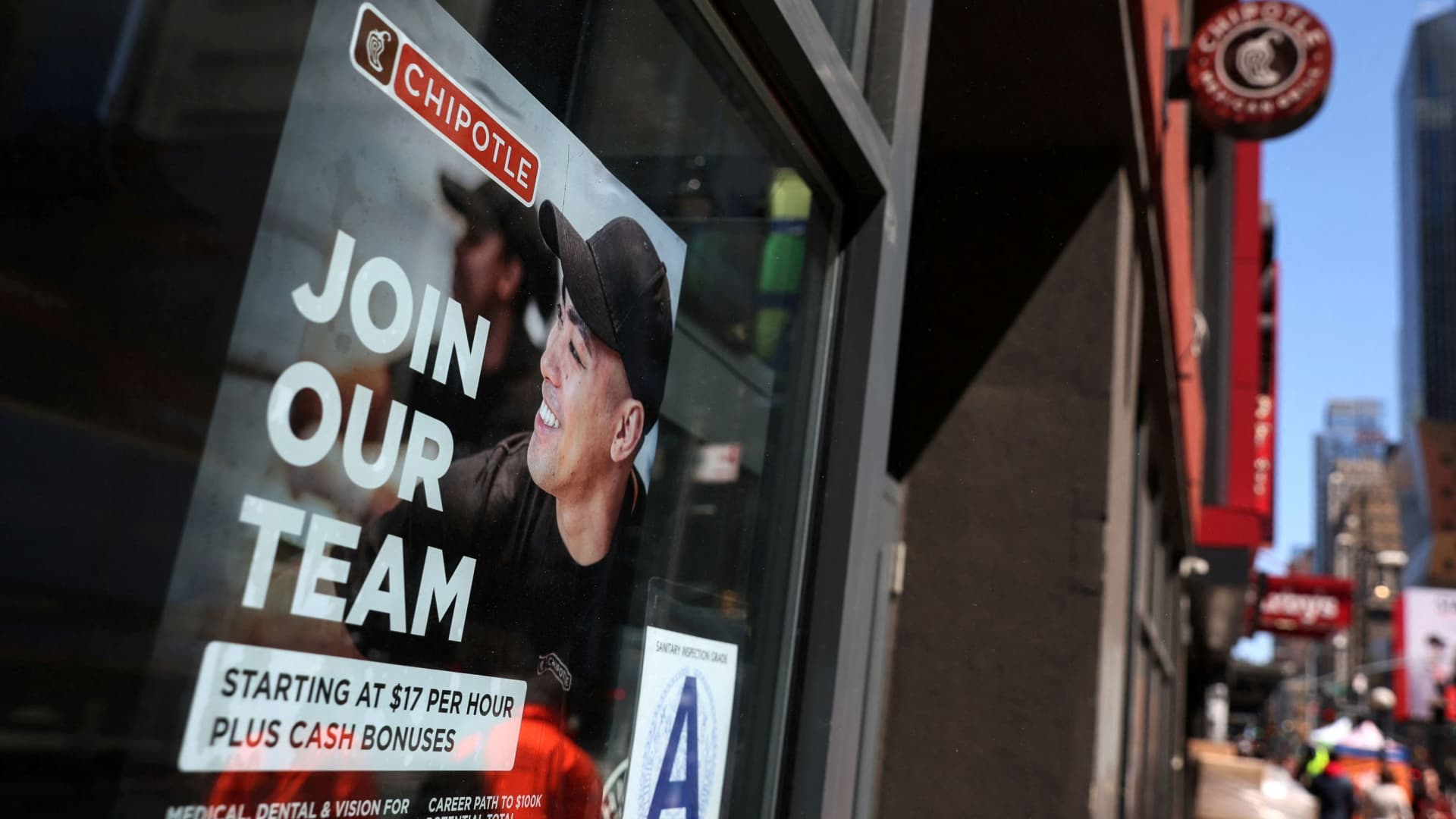

Chipotle is planning to hire 15,000 workers as it gears up for a busier spring season and to support its expansion.

Holding on

Businesses large and small are also finding they have to raise wages to attract and retain workers. Industries that fell out of favor with consumers and other businesses, such as restaurants and aerospace, are rebuilding workforces after shedding workers. Walmart said it would raise minimum pay for store employees to $14 an hour to attract and retain workers.

The Miner’s Hotel in Butte, Montana, raised hourly pay for housekeepers by $1.50 to $12.50 for that position in the last six weeks because of a high turnover rate, Cassidy Smith, its general manager.

Airports and concessionaires have also been racing to hire workers in the travel rebound. Phoenix Sky Harbor International Airport has been holding monthly job fairs and offers some staff child-care scholarships to help hiring.

Austin-Bergstrom International Airport, where schedules by seats this quarter has grown 48% from the same period of 2019, has launched a number of initiatives, such as $1,000 referral bonuses, and signing and retention incentives for referred staff.

The airport also raised hourly wages for airport facilities representatives from $16.47 in 2022 to $20.68 in 2023.

“Austin has a high cost of living,” said Kevin Russell, the airport’s deputy chief of talent.

He said employee retention has improved.

Electricians, plumbers and heating-and-air conditioning technicians in particular, however, have been difficult to retain because they can work at other places that aren’t 24/7 and at at higher pay, he said.

Many companies’ new workers need to be trained, a time-consuming element for some industries to ramp back up, even if it’s gotten easier to attract new employees.

“Hiring is not a constraint anymore,” Boeing CEO Dave Calhoun said on an earnings call in January. “People are able to hire the people they need. It’s all about the training and ultimately getting them ready to do the sophisticated work that we demand.”

— CNBC’s Amelia Lucas contributed to this article.