Products You May Like

Long-term wealth-building strategies should not be an all-or-nothing game.

Yet videos on YouTube, TikTok or Instagram may sometimes tout seemingly urgent get-rich-quick schemes.

“At the end of the day, if there is some misinformation that’s keeping people on the platform for a very long time, that video might get surfaced to more people than it should,” Humphrey Yang, a financial content creator, said Tuesday during the CNBC Financial Advisor Summit.

More from Personal Finance:

Robinhood to pay 1% ‘match on consumer contributions to IRAs

4 key year-end moves to ‘control your tax reporting destiny’

Why more workers need access to retirement savings

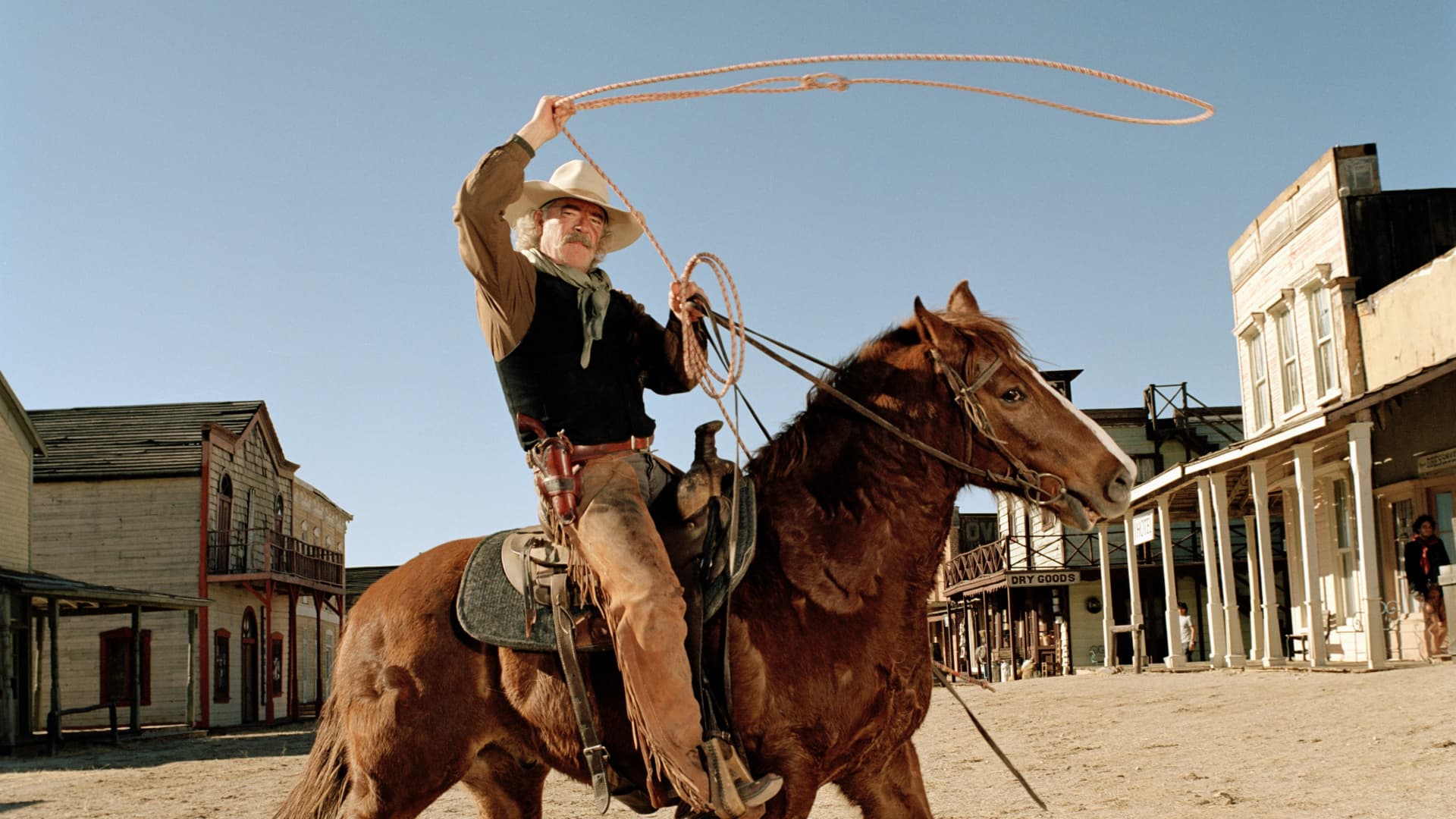

“It is a little bit of a Wild West out there still,” Yang said.

Platforms should implement checks and balances for their content, Yang said. But there are red flags that people should watch for in the content they consume before they put their money at risk.

Resist the urge to go all in on trends

In 2021, a video on cryptocurrencies would have received a ton of views on apps, Yang noted. Today, cryptocurrency videos are more niche.

“The public attention isn’t really there anymore, especially after the FTX fallout,” Yang said.

But crypto is an example of the very loud financial trends that tend to take over people’s attention spans on social media, said Brian Barnes, founder and CEO of financial services company M1.

For investors, it’s important to remember those trends can fade, and you can get burned.

While the stock market is valued at close to $50 trillion, crypto’s market cap is now down to $800 billion, after peaking at around $3 trillion.

Compared to nutrition, crypto is more like sugary snacks while long-term wealth building is like a balanced meal, Barnes said.

By taking a balanced approach to your investments, that will give you the biggest chance to create long-term wealth, Barnes said.

Do your due diligence

Another big red flag is if an investment’s promises seem too good to be true.

Content creators may tout strategies with unrealistic returns. Unfortunately, some investors won’t know any better, Yang said.

But it is possible to spot these schemes by doing some research on your own and comparing an investment’s promises to normal returns, Yang said. The S&P 500 Index‘s returns over the past 40 or 50 years would be a good benchmark, he said.

Seek professional expertise

Social media can still help you stay up to date on the latest financial information.

But the key is to know your source. Yang used to be a financial advisor with Series 7 and 66 licenses. Other content creators may not have the same level of expertise or positive intentions.

As information on social platforms becomes more personalized, there is the risk you may only see what you want.

“There’s a little bit of confirmation bias that they seek out the information they want to hear,” Barnes said.

To get a sense of whether a strategy is sound and fits your personal goals and risk appetite, you may want to run it by a reputable professional advisor.