Products You May Like

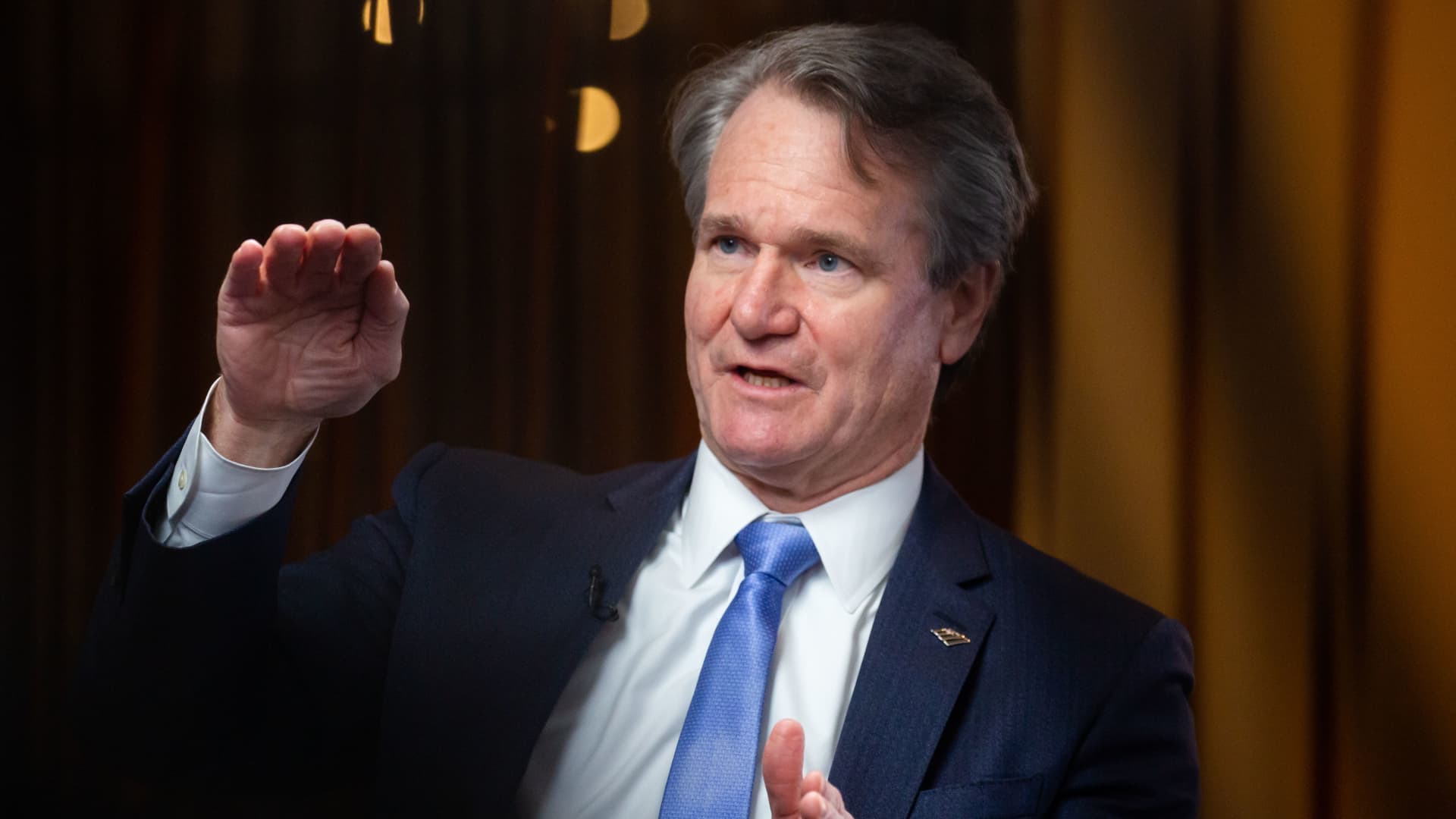

Brian Moynihan is no stranger to laying off workers — it’s one of the key ways he helped shape Bank of America after the 2008 financial crisis.

But in recent years, his firm has taken a different approach to managing its workforce. It raised the minimum wage paid to staff, gave them cash and stock bonuses and improved benefits.

While rivals including Goldman Sachs and Morgan Stanley cut workers recently ahead of a possible economic downturn in 2023, Moynihan and his CFO have said they don’t see the need for layoffs. That doesn’t mean the company’s head count won’t shrink, however, as the bank seeks to cut expenses amid the revenue pressures faced by the industry.

“We don’t lay off people, but we have an ability to reshape our headcount pretty quickly just by the turnover that occurs,” Moynihan said Tuesday during a financial conference.

In other words, Moynihan will allow positions to go unfilled as employees voluntarily depart, moving people around and retraining them as needed, he said.

The company’s head count has bounced between roughly 205,000 and 215,000 in recent years, Moynihan said. The bank had 213,270 employees as of Sept. 30, about 3,900 more than the year earlier.

“We’re up to about 215,000 [employees]; we need to run that back down,” he added.

Organizations as large as Bank of America are constantly losing and hiring employees, a churn that adds to expenses. The attrition rate in the industry is typically at least 10% annually, but can be several times higher in more difficult, lower-paid positions such as those in branches and call centers, or in highly competitive areas such as technology, according to an industry consultant.

Moynihan has used technology — from consolidating back-end processes to offering updated mobile apps — to help reduce noncustomer-facing employees. He expects to continue to do that next year, although strong wage inflation makes the job harder, he said.

“It is tedious and hard work and it’s harder when you have the inflationary aspects of what we’re all facing,” he said.