Products You May Like

Over the last few years, concerns have been raised that the existing international tax system does not properly capture the digitalization of the economy. Under current international tax rules, multinationals generally pay corporate income tax where production occurs rather than where consumers or, specifically for the digital sector, users are located. However, some argue that through the digital economy, businesses (implicitly) derive income from users abroad but, without a physical presence, are not subject to corporate income tax in that foreign country.

To address these concerns, the Organisation for Economic Co-operation and Development (OECD) has been hosting negotiations with more than 130 countries to adapt the international tax system. The current proposal would require some of the world’s largest multinational businesses to pay some of their income taxes where their consumers are located. This proposal is referred to as Pillar One.

Pillar One would replace some existing norms for taxing multinationals and run counter to some policies that countries have put in place to tax digital companies in recent years. The most common form is a digital services tax (DST), which is a tax on selected gross revenue streams of large digital companies.

Because Pillar One is focused on changing where profits are taxed, including for many large digital companies, digital services taxes are expected to be repealed in a transition process which is expected to be completed by the end of 2023.

On October 21, 2021, a joint statement from Austria, France, Italy, Spain, the United Kingdom, and the United States laid out a plan to roll back digital services taxes and retaliatory tariff threats once the Pillar One rules are implemented. On November 22, the U.S. Treasury announced that Turkey had agreed to the same terms.

The joint statement outlined a crediting approach to bridge between digital services tax liability and new Pillar One tax liability for the companies in scope of both between. This would be necessary for the transition expected to occur with minimal double taxation for the companies that would be liable under both Pillar One and current digital services taxes.

Though work has continued on Pillar One as reflected in the most recent policy document, it is still unclear how many different policies might be removed if Pillar One ever gets adopted.

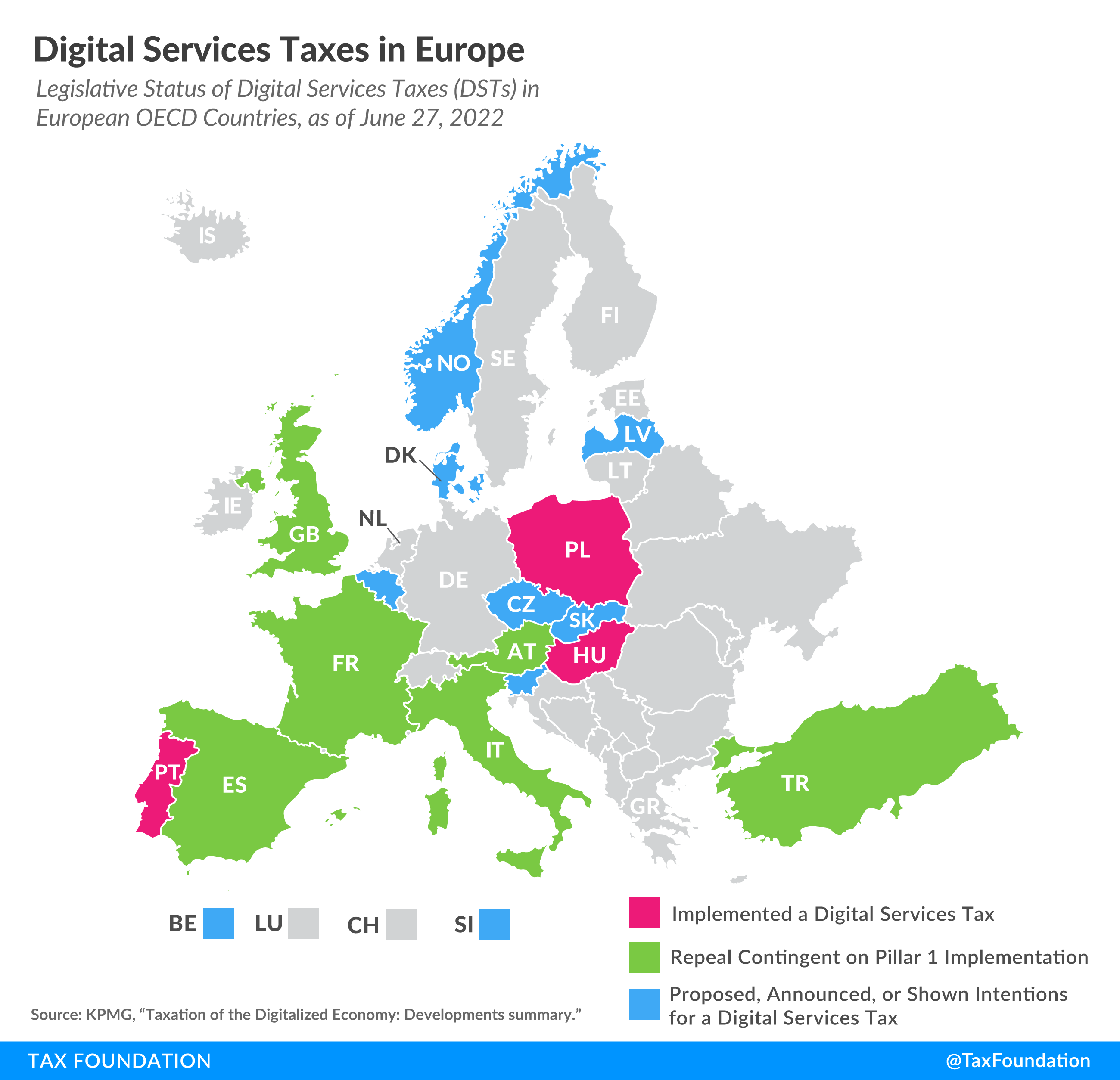

However, those are not the only countries that may be impacted by the OECD agreement. About half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact U.S. companies and are thus perceived as discriminatory, the United States had responded to the policies with retaliatory tariff threats.

Austria, France, Hungary, Italy, Poland, Portugal, Spain, Turkey, and the United Kingdom have implemented a digital services tax. Belgium, the Czech Republic, Denmark, and Slovakia have published proposals to enact a digital services tax, and Latvia, Norway, and Slovenia have either officially announced or shown intentions to implement a digital tax.

The proposed and implemented digital services taxes differ significantly in their structure. For example, while Austria and Hungary only tax revenues from online advertising, France’s tax base is much broader, including revenues from the provision of a digital interface, targeted advertising, and the transmission of data collected about users for advertising purposes. The tax rates range from 1.5 percent in Poland to 7.5 percent in both Hungary and Turkey (although Hungary’s tax rate is temporarily reduced to 0 percent). Denmark’s DST would apply to video streaming services.

These digital services taxes have been generally considered to be interim measures until an agreement was reached at the OECD level, and now that such an agreement has been reached it will be important to monitor how countries change or repeal their digital services taxes. At the same time, the United Nations (UN) has added special provisions for income from automated digital services to the UN Model Tax Convention (see Article 12B), which would apply to treaty parties that agree to its inclusion.

| Country | Tax Rate | Scope | Global Revenue Threshold | Domestic Revenue Threshold | Status |

|---|---|---|---|---|---|

| Austria (AT) | 5% | Online advertising | €750 million (US $840 million) | €25 million ($28 million) | Implemented (Effective from January 2020); joined statement on October 21, 2021 that repeal of the DST would be contingent on Pillar One implementation |

| Belgium (BE) | 3% | Selling of user data | €750 million ($840 million) | €5 million ($5.6 million) | Proposed (A DST was first introduced in January 2019 but was rejected in March 2019; an adjusted DST proposal was reintroduced in June 2020; however, the new government, sworn in October 1, 2020, announced it will wait for a global solution) |

| Czech Republic (CZ) | 5% | · Targeted advertising · Use of multilateral digital interfaces · Provision of user data (additional thresholds apply) |

€750 million ($840 million) | CZK 100 million ($4 million) | Proposed (Discussions delayed due to COVID-19 pandemic; there is a proposed amendment that reduces the tax rate from 7% to 5%) |

| Denmark (DK) | 6% | Online streaming services | NA | NA | Proposed to be implemented in 2024 |

| France (FR) | 3% | · Provision of a digital interface · Advertising services based on users’ data |

€750 million ($840 million) | €25 million ($28 million) | Implemented (Retroactively applicable as of January 1, 2019); joined statement on October 21, 2021 that repeal of the DST would be contingent on Pillar One implementation |

| Hungary (HU) | 7.5% | Advertising revenue | HUF 100 million ($344,000)) | N/A | Implemented (As a temporary measure, the advertisement tax rate has been reduced to 0%, effective from July 1, 2019 through December 31, 2022) |

| Italy (IT) | 3% | · Advertising on a digital interface · Multilateral digital interface that allows users to buy/sell goods and services · Transmission of user data generated from using a digital interface |

€750 million ($840 million) | €5.5 million ($6 million) | Implemented (Effective from January 2020); joined statement on October 21, 2021 that repeal of the DST would be contingent on Pillar One implementation |

| Latvia (LV) | 3% | – | – | – | Announced/Shows Intentions (The Latvian government commissioned a study to determine the increase of tax revenue based on the assumption that the country levies a 3% DST) |

| Norway (NO) | – | – | – | – | Announced/Shows Intentions (Norway planned to introduce a unilateral measure in 2021 but no announcements have been made since the Inclusive Framework agreement in 2021) |

| Poland (PL) | 1.5% | Audiovisual media service and audiovisual commercial communication | – | – | Implemented (Effective from July 2020; there is a separate proposal to tax advertisement revenues of broadcasters, tech companies, and publishers) |

| Portugal (PT) | 4%, 1% | Audiovisual commercial communication on video-sharing platforms (4%), subscriptions for video-on-demand services | Implemented (Effective from February 2021) | ||

| Slovakia (SK) | – | – | – | – | Proposed (The Ministry of Finance opened a consultation on a proposal to introduce a DST on revenue of nonresidents from provision of services such as advertising, online platforms, and sale of user data; however, there were no further steps taken and none of the political parties have put forward digital tax as their priority agenda) |

| Slovenia (SI) | – | – | – | – | Announced/Shows Intentions (The Ministry of Finance announced a government proposal to submit a draft bill to the National Assembly introducing a digital services tax by April 1, 2020; however, there has been no development so far) |

| Spain (ES) | 3% | · Online advertising services · Sale of online advertising · Sale of user-data |

€750 million ($840 million) | €3 million ($3 million) | Implemented (Effective from January 2021); joined statement on October 21, 2021 that repeal of the DST would be contingent on Pillar One implementation |

| Turkey (TR) | 7.5% | Online services including advertisements, sales of content, and paid services on social media websites | €750 million ($840 million) | TRY 20 million ($4 million) | Implemented (Effective from March 2020; the president can reduce the DST rate as low as 1% or increase it as much as 15%); agreed to same terms of the joint statement on October 21, 2021 that repeal of the DST would be contingent on Pillar One implementation |

| United Kingdom (GB) | 2% | · Social media platforms · Internet search engine · Online marketplace |

£500 million ($638 million) | £25 million ($32 million) | Implemented (Retroactively applicable as of April 1, 2020); joined statement on October 21, 2021 that repeal of the DST would be contingent on Pillar One implementation |

|

Sources: KPMG, “Taxation of the digitalized economy: Developments summary,” Oct. 29, 2021, https://tax.kpmg.us/content/dam/tax/en/pdfs/2021/digitalized-economy-taxation-developments-summary.pdf; Bloomberg Tax, “Poland’s Government Plans to Approve New Ad Tax Bill in 1Q,” Feb. 2, 2021, https://www.news.bloombergtax.com/daily-tax-report/polands-government-plans-to-approve-new-ad-tax-bill-in-1q; U.S. Department of the Treasury, “Joint Statement from the United States, Austria, France, Italy, Spain, and the United Kingdom, Regarding a Compromise on a Transitional Approach to Existing Unilateral Measures During the Interim Period Before Pillar 1 is in Effect,” Oct. 21, 2021, https://home.treasury.gov/news/press-releases/jy0419; and U.S. Department of the Treasury, “Joint Statement from the United States and Turkey Regarding a Compromise on a Transitional Approach to Existing Unilateral Measures During the Interim Period Before Pillar 1 Is in Effect,” Nov. 22, 2021, https://home.treasury.gov/news/press-releases/jy0500. |

|||||