Products You May Like

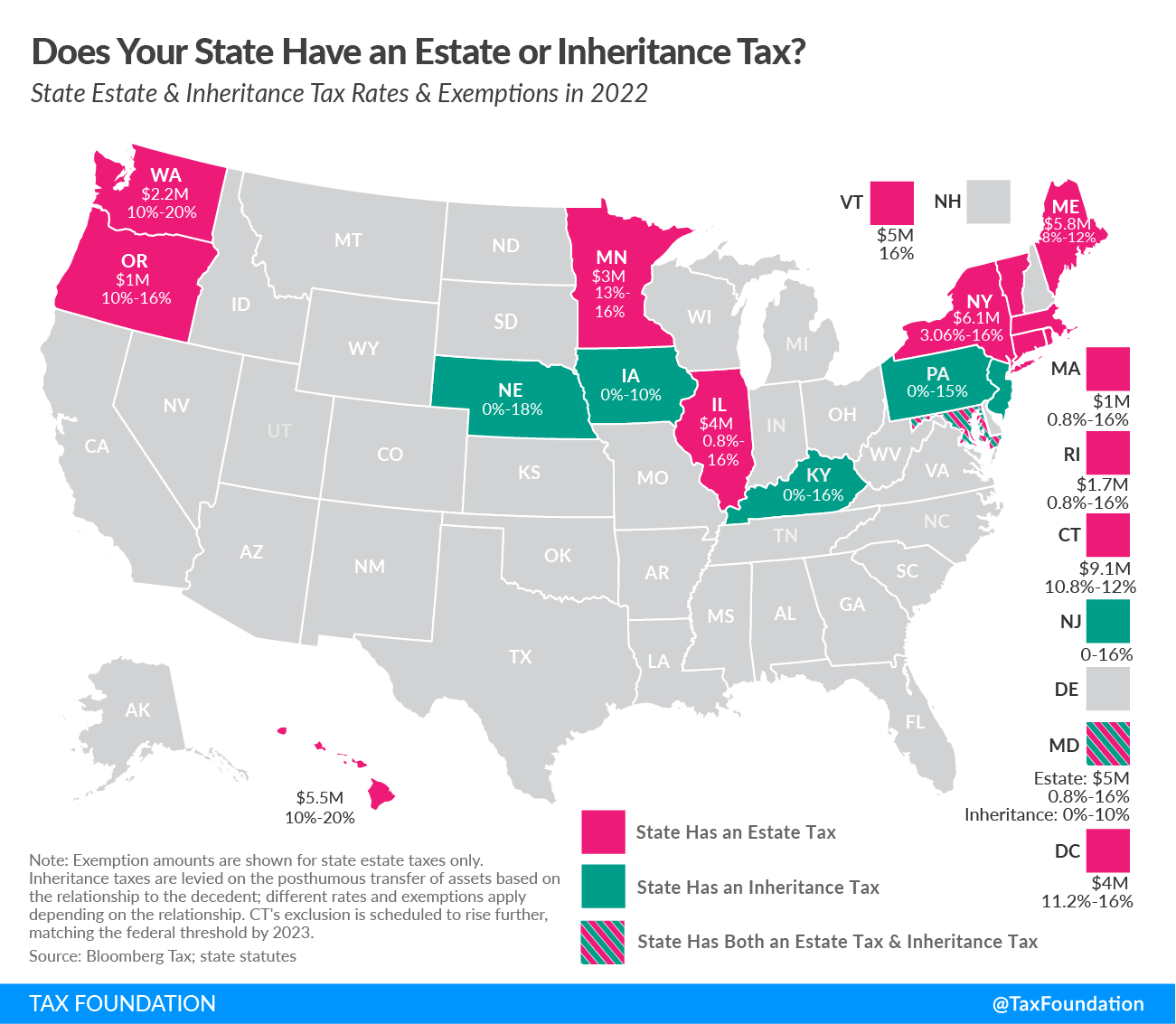

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional state estate tax or state inheritance tax. Twelve states and the District of Columbia impose estate taxes and six impose state inheritance taxes. Maryland is the only state to impose both a state estate tax rate and a state inheritance tax rate.

Estate taxes are paid by the decedent’s estate before assets are distributed to heirs and are thus imposed on the overall value of the estate. Inheritance taxes are remitted by the recipient of a bequest and are thus based on the amount distributed to each beneficiary.

Hawaii and Washington have the highest estate tax top rates in the nation at 20 percent. Eight states and the District of Columbia are next with a top rate of 16 percent. Massachusetts and Oregon have the lowest exemption levels at $1 million, and Connecticut has the highest exemption level at $9.1 million.

Of the six states with inheritance taxes, Nebraska has the highest top rate at 18 percent. Maryland—which also has an estate tax—imposes the lowest top rate at 10 percent. All six states exempt spouses, and some fully or partially exempt immediate relatives. Compare state estate tax rates and state inheritance tax rates below.

In 1926, the federal government began offering a generous federal credit for state estate taxes, meaning taxpayers were paying the same amount in estate taxes whether or not their state levied the tax. This made estate taxes an attractive option for states. After the federal government fully phased out the state estate tax credit, some states stopped collecting estate taxes by default, as their provisions were directly linked with the federal credit, while others responded by repealing their tax legislatively.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the federal exemption hurt a state’s competitiveness. Delaware repealed its estate tax at the beginning of 2018. New Jersey finished phasing out its estate tax at the same time, and now only imposes an inheritance tax.

Connecticut continues to phase in an increase to its estate exemption, planning to match the federal exemption by 2023. However, as the exemption increases, the minimum tax rate also increases. In 2021, rates started at 10.8 percent, while the lowest rate in 2022 is 11.6 percent. Connecticut’s estate tax will have a flat rate of 12 percent by 2023.

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year (from the baseline rates) until 2025, when the tax will be fully eliminated. The top rate in 2020 was 15 percent, but a reduction of 40 percent brings the top rate to 9 percent in 2022.

Vermont finished phasing in an exemption increase in 2021, bringing the exemption to $5 million that year, compared to $4.5 million in 2020.

The District of Columbia moved in the opposite direction, lowering its estate tax exemption from $5.8 million to $4 million in 2021, but simultaneously dropping its bottom rate from 12 to 11.2 percent. An inflation adjustment then brought the exemption to $4.3 million for 2022.

In the Tax Cuts and Jobs Act of 2017, the federal government raised the estate tax exclusion from $5.49 million to $11.2 million per person, though this provision expires December 31, 2025. Initially, some states conformed to this higher exclusion, though states have since decoupled from it, offering lower exemptions than those permitted by the federal government.

Estate and inheritance taxes are burdensome. They disincentivize business investment and can drive high-net-worth individuals out-of-state. They also yield estate planning and tax avoidance strategies that are inefficient, not only for affected taxpayers, but for the economy at large. The handful of states that still impose them should consider eliminating them or at least conforming to federal exemption levels.