Products You May Like

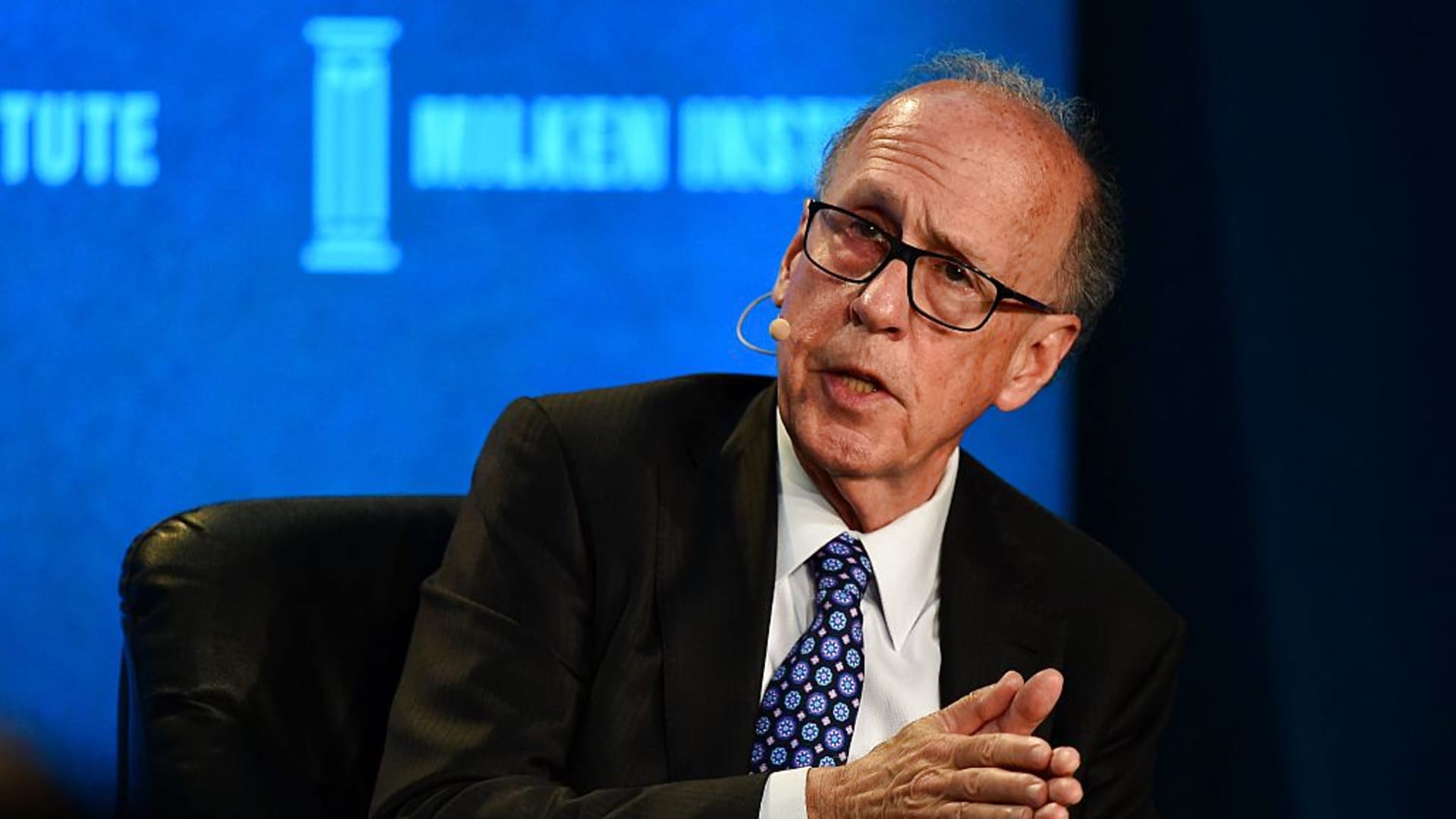

Stagflation is making a comeback, according to former Morgan Stanley Asia chairman Stephen Roach.

He warns the U.S. is on a dangerous path that leads to higher prices coupled with slower growth.

“This inflation problem is widespread, it’s persistent and likely to be protracted,” Roach told CNBC’s “Fast Money” on Thursday. “The markets are not even close to discounting the full extent of what’s going to be required to bring the demand side under control… That just underscores the deep hole [Fed chief] Jerome Powell is in right now.”

Roach, a Yale University senior fellow and former Federal Reserve economist, calls stagflation his base case and the peak inflation debate absurd.

“The demand side has really gotten away from the Fed,” he said. “The Fed has a massive amount of tightening to do.”

Roach expects inflation to stay above 5% through the end of the year. At the current pace of interest rate hikes, the Fed wouldn’t meet that level.

“50 basis points doesn’t cut it. And, by ruling out something larger than that he [Powell] just sends a signal that his hands are tied,” added Roach. “The markets are uncomfortable with that conclusion.”

The Dow is on pace for its eighth negative week in a row for the first time since 1932. The S&P 500 and the tech-heavy Nasdaq are tracking for their worst weekly losing streaks since 2001.

Roach started sounding the alarm on 1970s-type inflation risks two years ago, during the early stages of the pandemic. He listed historically low interest rates, the Fed’s easy money policies and the country’s enormous debt.

His warning got louder last September on CNBC. Roach cautioned the U.S. was one supply chain glitch away from stagflation.

And now he sees even more reasons to go on alert.

“I would add to that zero-Covid in China along with the repercussions of the war in the Ukraine,” Roach said. “That will keep the supply side well-extended in terms of clogging price discovery through the next several years.”

CNBC’s Chris Hayes contributed to this report.