Products You May Like

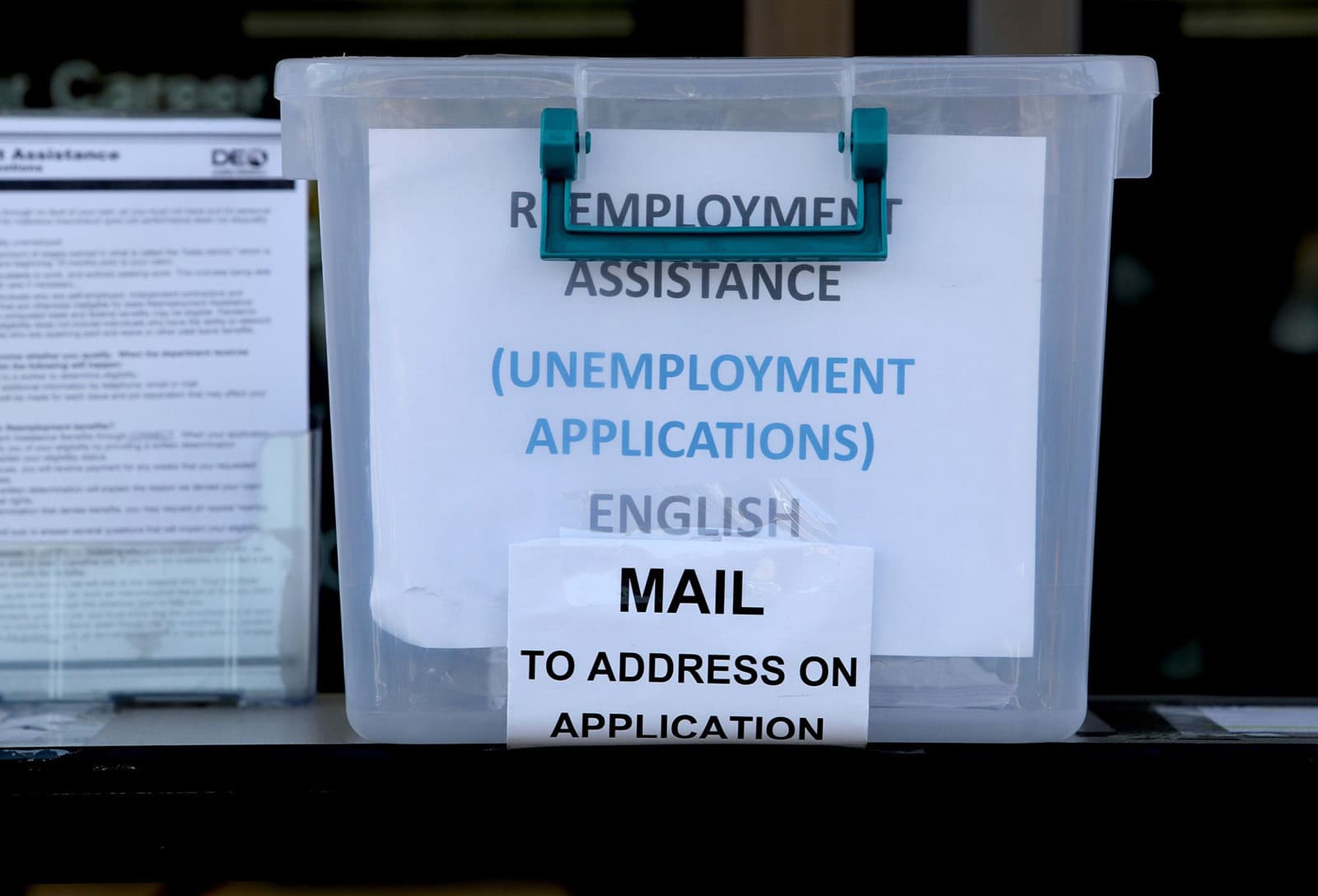

More than $87 billion in unemployment benefits funded by the federal government was likely siphoned from the system during the Covid-19 pandemic, much of it due to fraud, according to a U.S. Department of Labor report.

Congress authorized many new programs in the pandemic’s early days to support millions of workers who’d lost their jobs. Those programs, which ended on Labor Day this year, raised weekly benefits, extended the duration of aid and expanded the pool of jobless Americans eligible for payments.

The federal government issued $872 billion in total benefits as of Sept. 30, according to an estimate from the Labor Department’s Office of Inspector General, which released a semiannual report for Congress on Monday.

However, the “unprecedented” level of funding led to a surge in theft and fraud, according to the watchdog, which audits Labor Department programs and operations.

It estimates 10% or more (at least $87 billion) of the federal money was likely lost to “improper payments,” with a “significant portion attributable to fraud.”

(States, which administer benefits, may have issued some payments in error for reasons unrelated to fraud, such as processing errors or application mistakes from claimants.)

More from Personal Finance:

Control of Senate may depend on fate of paid family leave legislation

Financial watchdog cracks down on bank overdraft fees

More employers to require Covid vaccines as omicron fears grow

Much of the criminal activity was focused on one temporary program, Pandemic Unemployment Assistance, which expanded aid to the self-employed, gig workers and others who don’t typically qualify for state unemployment insurance, according to labor experts.

Lawmakers initially let program applicants self-attest their qualification for benefits. (This isn’t true of traditional state benefits, which become available after a more thorough verification.)

The move helped expedite aid to ailing households during the deepest recession since the Great Depression; but the laxer requirements, coupled with a $600 weekly increase in benefits, led thieves to try exploiting the system.

Much of the unemployment fraud has been linked to organized crime rings that bought identity information stolen in past data breaches, the Labor Department has said. Criminals use this data to apply for benefits in others’ names.

“I think the problem with unemployment fraud was serious and unprecedented, and I don’t think the states were ready for how stolen identities could be used to take advantage of these programs,” said Andrew Stettner, a senior fellow and unemployment expert at The Century Foundation, a progressive think tank.

“[However] states didn’t have much time to build them out with the right protections,” Stettner said of the temporary federal programs. “And having a more permanent system would certainly help.”

While the high level of fraud is problematic, it doesn’t diminish the overall success of the pandemic-era programs, which cut poverty and led to a speedy economic recovery, Stettner said. Expanded unemployment benefits prevented 5.5 million people from falling into poverty in 2020, according to the U.S. Census Bureau.

Investigative work involving unemployment benefits increased by 1,000 times more than the usual amount during the pandemic, according to the Inspector General report. Such work now accounts for 92% of the watchdog’s investigative case inventory, up from 12% prior to the pandemic.

Lawmakers and states have cracked down to try limiting theft.

For example, Congress passed a relief law in December 2020 that tightened some of the documentation requirements to collect pandemic benefits. Many states implemented identity verification measures. The Labor Department is also providing up to $240 million to states to help prevent and fight fraud in both the traditional and pandemic-era unemployment programs.

However, some safeguards have ensnared legitimate claimants and delayed aid.