Products You May Like

As Congress considers several tax proposals designed to raise taxes on high-income earners, it’s worth considering the distribution of the existing tax code. While the image that rich Americans pay little taxes is popular, it’s a misconception: high-income individuals already pay a large share of taxes, even when compared to their share of national income.

Data and analysis from the preeminent nonpartisan governmental research organizations confirms this pattern.

This August, the Congressional Budget Office (CBO) released its annual Distribution of Household Income report, this year relying on data from 2018. The report examines the distribution of household income (as one might guess), as well as taxes and transfer payments. The data shows that top-earning households pay substantial federal taxes. Notably, while the top 1 percent of earners took home 18.3 percent of market income in 2018, they paid 25.9 percent of all federal taxes; by the same token, the top 20 percent of earners received 59.1 percent of market income yet paid 68.9 percent of federal taxes.

The Treasury Department has also released data confirming the above pattern. In a report released this April, they estimated the distribution of federal tax burden across the income spectrum in 2022. According to these estimates, the top 1 percent under current law will pay the highest average effective tax rate, when considering all federal taxes. This difference is largely due to the significant progressivity of the individual income tax: the bottom 40 percent of taxpayers on average pay negative effective personal income tax.

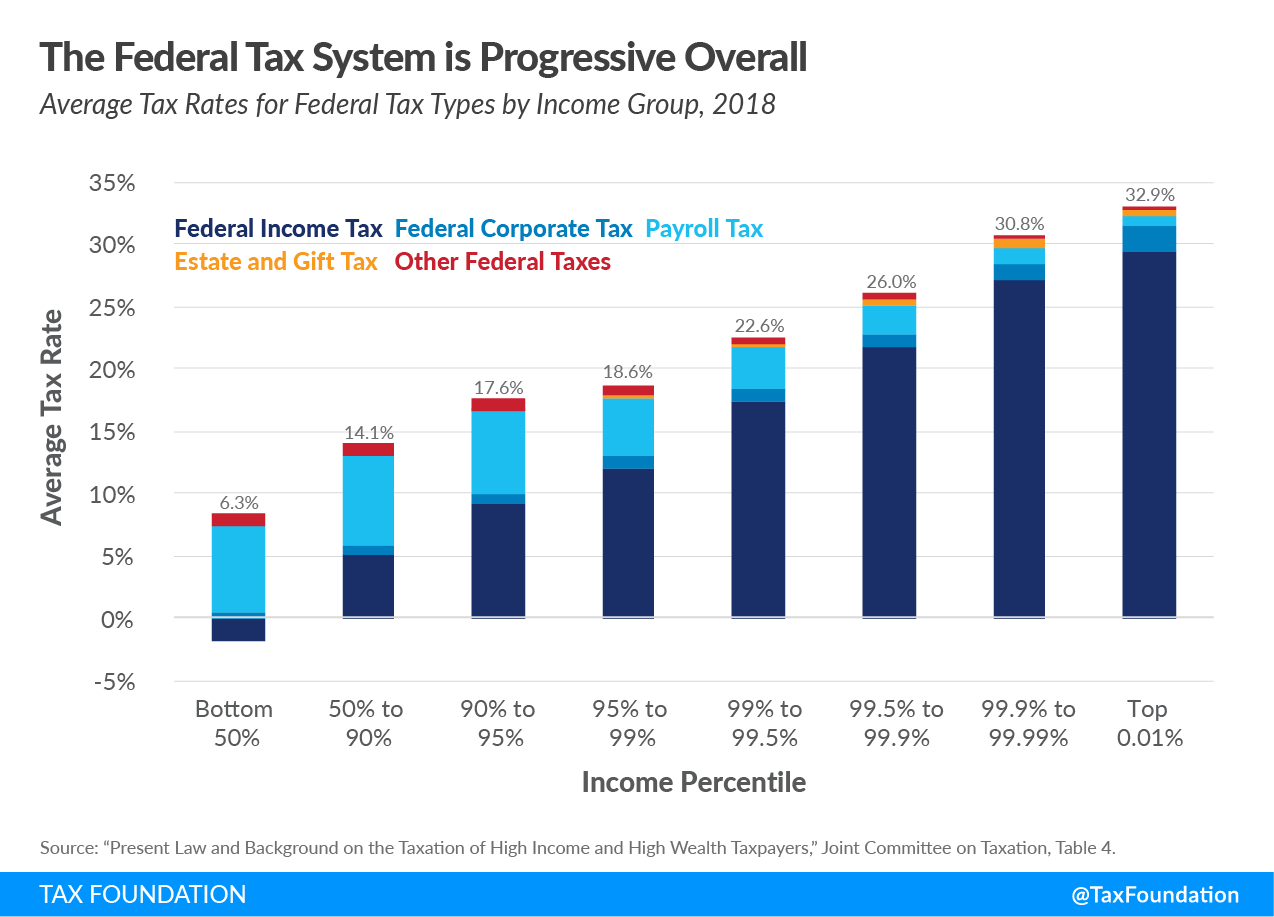

The Joint Committee on Taxation (JCT) published an analysis reaching a similar conclusion about the distribution of the tax code in 2018. My colleague Garrett Watson discussed the data this May. The original report found that the burden of federal taxes was much higher on high-earning households. They paid a much higher effective rate in total, similarly thanks to the progressivity of the personal income tax.

It’s also worth noting that these analyses predominantly focus on pre-pandemic data. The fiscal response to COVID-19 relied heavily on refundable tax credits, lowering the effective personal income tax rate for a majority of taxpayers to below or nearly zero. The Tax Policy Center recently estimated that 60.6 percent of households paid no individual income tax in 2020. In light of these estimates, distribution of the U.S. tax burden was likely even more skewed towards wealthy taxpayers.

Of course, some people will argue that even if the tax code is currently progressive, it should be even more progressive. But they should not dispute the fact that the wealthy pay a larger share of federal taxes than they earn of national income.

Was this page helpful to you?

Thank You!

The Tax Foundation works hard to provide insightful tax policy analysis. Our work depends on support from members of the public like you. Would you consider contributing to our work?

Contribute to the Tax Foundation

Share This Article!

Let us know how we can better serve you!

We work hard to make our analysis as useful as possible. Would you consider telling us more about how we can do better?